UNDER CONSTRUCTION

UNDER CONSTRUCTION

UNDER CONSTRUCTION

UNDER CONSTRUCTION

UNDER CONSTRUCTION

UNDER CONSTRUCTION

UNDER CONSTRUCTION

UNDER CONSTRUCTION

General Information

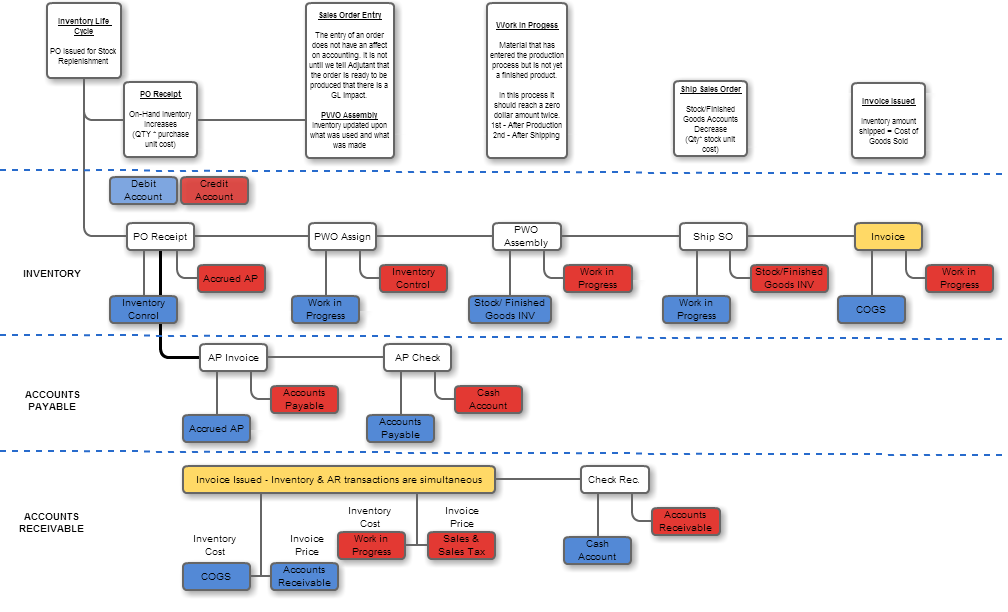

In the double-entry accounting system, each accounting entry records related pairs of financial transactions for asset, liability, income, expense, or capital accounts. Recording of a debit amount to one account and an equal credit amount to another account results in total debits being equal to total credits for all accounts in the general ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having positive balances will be equal to the aggregate balance of all accounts having negative balances. Accounting entries that debit and credit related accounts typically include the same date and identifying code in both accounts, so that in case of error, each debit and credit can be traced back to a journal and transaction source document, thus preserving an audit trail. The rules for formulating accounting entries are known as "Generally Accepted Accounting Principles". The accounting entries are recorded in the "Chart of Accounts". Regardless of which accounts and how many are impacted by a given transaction, the fundamental accounting equation A = L + OE will hold, i.e. assets equals liabilities plus owner's equity.

Accouting Walk-thru |

Receiving Inventory

Adjutant Entry

Accounting Entry

Purchase Order Received:

Debit to the Inventory Account

Credit to the PO Clearing Account

Invoice for Purchase order:

Debit to the PO Clearing Account

Credit to the Account Payable Account

Pay Invoice:

Debit to the Accounts Payable Account

Credit to the Cash in Bank Account

When a

stock item is received, the Inventory Control account is determined by the Control Account listed on the

OHF tab of the Item Master.

If that account is blank or invalid, then the Control Account listed on the

Warehouse screen will be used.

If that account is blank or invalid, then the Control Account listed on the

CID Maintenance screen will be used.

Non-Stock items follow the same rules, however the user may enter a

GL account directly onto the PO to debit an account.

Inventory Production

Material Assigned

Credit Inventory Account

Shipping Inventory

Account Definitions

Inventory Clearing:

Accured AP:

PO Clearing: The PO Clearing account is determined by the PO Clearing account listed the

OHF tab of the Item MasterIf that account is blank or invalid, then the PO Clearing account listed on the

Warehouse screen. will be used.

If that account is blank or invalid, then the Control Account listed on the

CID Maintenance screen will be used.

: Default variance/balancing account when PO Receipt does not match AP Invoice amount.

Suspense: Suspense account is used if the batch generator cannot match a transaction to an existing GL Account.

Since the batches need to balance, everything has to post somewhere. If the account number cannot be found, the suspense account is used instead.

Examples: A blank account, an account created by the GL Group logic that does not exist, an account that was setup at one time,and was deleted or is now not active

Modification Processor

The Modification Processor (or "Coil Processor") is used to associate processing costs back to an item and to create new items. Information on page use can be found on the

Modification Processing wiki page

1) For each Input,

Cost is removed from Item Control Account based on OHF, if no acct on OHF record, whse acct is used.

Cost is added to IC Clearing Acct based on OHF, if no acct on OHF record, whse acct is used.

2) For Each Output,

New Cost is added to Item Control Account based on OHF, if no acct on OHF record, whse acct is used.

New Cost is removed to IC Clearing Acct based on OHF, if no acct on OHF record, whse acct is used.

If whse acct is used, StkFlag is used to select Stk or NonStk Item Acct

The input cost will always equal the output cost, but they can end up in different acounts based on the types of items used/created