Cash Receipts Import Guide

From Adjutant Wiki

Contents

- 1 General Data Import Notes

- 2 Cash Receipt Import Notes

- 3 Cash Receipt Import File Data Scrubbing

- 4 Cash Receipt Import Screen (IMPORTCASHREC)

- 5 Cash Receipt Import Header File Definitions

- 6 Cash Receipt Import Reconciliation

- 7 Cash Receipt Import Additional Steps

- 8 Cash Receipt Import Database Tables

General Data Import Notes

Refer to the Data Import General Information page for information and guidance on general import timeline, formatting import templates, as well as how to ensure you are using the most current template information for data imports.

Cash Receipt Import Notes

Timing and Preparation

The Cash Receipt Import should occur after all customers have been imported, which should mean that all Address Book setup items have been completed, and all the General Ledger Chart of Accounts has been imported. The Address Book Setup Guide covers all of the Rule Maintenance records that should be completed prior to importing vendor records.

The AR Invoice Import should be completed before the Cash Receipts Import so that the invoice numbers exist for applied payments.

The Cash Receipt Import will create transactions for Bank Reconciliation. Imported transactions can be marked as cleared in Bank Reconciliation with the cleared date already set on the import file. If the Bank Rec fields are left blank on the import file, the imported records will have to be cleared in Bank Rec.

General Notes

Imported Cash Receipt amounts will display on the Payment History tab of the associated invoice, but will not affect the invoice balance. It is assumed that the associated invoice balance has already been imported with the correct balance amount which accounts for any historical cash receipts. Cash receipt records are imported to show the detailed receipts that support the difference between the original invoice amount and the current balance.

Date fields - Confirm that the correct dates are placed in the Transaction Date and the Postmark Date fields. The Postmark Date is used as the invoice paid date and is considered the date that the receipt was posted. The Transaction Date is used for reports selects based on transaction date, and is carried through to Bank Rec as the transaction date.

Adjustments and Discounts - Adjustment amounts and discount amounts entered on the import file are imported as separate receipt amounts under the same reference number as the cash received amount. When importing receipts with discounts or adjustments included, the cash amount should reflect the actual cash received and the discount or adjustment amounts should reflect only the discount or adjustment value.

Deposits/Open Credits - Imported credits/deposits will NOT create a corresponding invoice record. The imported credits/deposits create a cash receipt record that will show on Cash Receipts reporting, but they can not be applied toward open invoices unless a separate matching invoice record is created. Deposits/Credits imported through cash receipts will be created with an invoice number of '_DEPOSIT-YYYYMMDD' or '_OPENCR-YYYYMMDD' where the date matches the postmark date from the import file. In order to import a deposit/credit record that can be applied as payment, the receipt must be imported as an invoice record through the AR Invoice Import.

Cash Receipt Import File Data Scrubbing

Every customer's data will have different issues that need addressing. Some of the issues will not make themselves visible until after the data has been imported and is in use during parallel testing. This is why it is critically important to perform an early import, and keep accurate notes on issues that need to be addressed on a supplemental import, or for a complete re-import. Some common things that need attention during AP invoice data scrubbing include:

- Dates - Make sure all dates follow the MM/DD/YYYY format before importing. Also review each date column and work with the customer to ensure the right dates are being imported in the right columns.

- Cash Accounts - Make sure the cash account is entered for each imported line. The cash account controls whether or not the receipt shows up in a GL account tracked by Bank Rec. It also controls how the receipt records are selected on various reports.

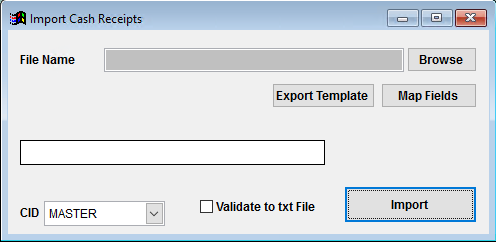

Cash Receipt Import Screen (IMPORTCASHREC)

Menu Location: Transaction>>Importers/Exporters>>Accounting>>Cash Receipts Import

File Name/Browse: Use the Browse button to locate and select the completed Cash Receipts import template file (in XLS format).

Export Template: Generates a blank Cash Receipt import template file

Map Fields: Fields must be mapped prior to importing. If no changes have been made to the column headings, the mapping screen should show all green, and you can click OK to continue. If any of the Input Field Name columns on the left are red, single-click on the line on the left column, and then double-click the desired mapped field in the right column to complete the mapping. Repeat for any red lines on the left that should be mapped. If there are additional columns in the source file that should NOT be mapped, they can be left unmapped (displayed in red). Mandatory fields will require that they be mapped before clicking OK.

Validate to TXT file: Selecting this box will create a TXT errors file listing any rows that would create errors such as invalid data, or duplicate records. If no errors are found in the file, the import will still process and no error file will be generated. Checking the validate box only prevents the import process if errors are encountered.

Cash Receipt Import Header File Definitions

Required fields are indicated with an *

f1 - InvNo - AR Invoice to apply the cash receipt as a payment. The invoice record must exist in Adjutant. If left blank, the cash receipt will be created as an open credit or a deposit.

*f2 - CustNo - Bill To customer number in Adjutant

*f3 - TranDate - Transaction Date (MM/DD/YYYY). Used for report selects to differentiate between the GL posting date and the receipt date.

*f4 - PostDate - Postmark or Posted date (MM/DD/YYYY)

*f5 - CashAmt - Dollar amount of cash received

*f6 - RefNo - Reference number or check number

*f7 - CashAcct - Cash GL account, typically a banking account, deposit account, or other cash account

f8 - AdjAmt - Dollar amount of invoice adjustment. This is added to the cash amount value to calculate total payment.

f9 - DiscAmt - Dollar amount of invoice discount. This is added to the cash amount value to calculate total payment.

f10 - Deposit - Enter Y to flag this receipt as a deposit. The invoice number should be blank. If the invoice number is blank and the deposit flag is blank, the record will be imported as an open credit.

f11 - BankDepNum - Bank deposit number. This is used to group and sort Cash Receipts reporting, as well as Bank Reconciliation.

f12 - ClearDate - Bank Reconciliation cleared date. If a date is filled in, the record will be marked as cleared in Bank Reconciliation.

f13 - SNote - Cash Receipt note

f14 - CRTtype - Cash Receipt Type. Valid Cash Receipt type names from the CASHRECTYPE rule should be used.

Cash Receipt Import Reconciliation

Reconciling imported data should begin with spot-checking several records field-by-field for complete data import. Pick records from the source file that have the most data columns filled in. Verify that all source file data fields imported correctly and display as expected.

Run the AR Cash Receipts Report and verify that the imported receipts are reported as expected under the correct customer records. Compare the report totals against the total dollars on the import file for cash amount, discount, and adjustment totals. Verify the amounts total correctly by cash GL account.

Review several AR invoices and verify that the imported cash receipts show up as payments against the corresponding invoices.

Run the AR Aging with Payments Report and verify that receipts and adjustments show up on the report as expected.

Cash Receipt Import Additional Steps

If using Bank Reconciliation, review Bank Rec for the imported transactions. Reconcile or adjust the imported receipts as needed.

Cash Receipt Import Database Tables

CASHREC - Each imported receipt creates a new KEYNO in the CASHREC table. The customer number will show in the PAYEE field as the ENTID. If the receipt is linked to an invoice record, the link will be in the BILLH field which matches the invoice KEYNO from the BILLMAST table.