Asset Import Guide

From Adjutant Wiki

Contents

General Data Import Notes

Refer to the Data Import General Information page for information and guidance on general import timeline, formatting import templates, as well as how to ensure you are using the most current template information for data imports.

Asset Import Notes

Timing and Preparation

The Asset Import can occur any time after all customers have been imported, all Inventory Owners have been established, and Item Master records have been imported. Workflow Routes, Asset Type definitions, and Departments should also be set up prior to importing Assets if the customer intends to use those features with Assets.

General Notes

The Asset Tag ID is the key value used to check for duplicate records. The Asset Import will not create or updates duplicate records.

If using asset depreciation options, the 'DEPSCH' Asset Attribute must be established in the Asset Attributes (ATT_ASSET) Rule Maintenance record and tied to the 'ASSETDEP' form in the rule.

Asset Import File Data Scrubbing

Every customer's data will have different issues that need addressing. Some of the issues will not make themselves visible until after the data has been imported and is in use during parallel testing. This is why it is critically important to perform an early import, and keep accurate notes on issues that need to be addressed on a supplemental import, or for a complete re-import. Some common things that need attention during Sales Order data scrubbing include:

- Dates - Make sure all dates follow the MM/DD/YY format before importing. Also review each date column and work with the customer to ensure the right dates are being imported in the right columns.

- TagID - The 'TAGID' column establishes the unique key (along with the database keyno) for the imported assets. Review the file carefully for duplicates, blank entries, or incomplete data.

- Depreciation Fields - If using, review the depreciation values carefully with the customer and confirm that the correct methods and values are being imported.

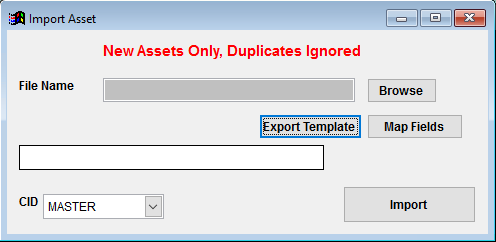

Asset Import Screen (IMPORTASSET)

Menu Location: Transaction>>Importers/Exporters>>Item Control>>Asset Import

File Name/Browse: Use the Browse button to locate and select the completed Asset Import template file (in XLS format).

Export Template: Generates a blank Asset Import template file

Map Fields: Fields must be mapped prior to importing. If no changes have been made to the column headings, the mapping screen should show all green, and you can click OK to continue. If any of the Input Field Name columns on the left are red, single-click on the line on the left column, and then double-click the desired mapped field in the right column to complete the mapping. Repeat for any red lines on the left that should be mapped. If there are additional columns in the source file that should NOT be mapped, they can be left unmapped (displayed in red). Mandatory fields will require that they be mapped before clicking OK.

Asset Import File Definitions

- indicates a required entry

CurLoc - Organization number for the current location of the asset

Owner - Asset Owner organization number

BusUse - Business Use percentage value as a whole number. For example, for 50% business use, enter '50'.

Note - This field is not in use

AssetDep - Enter 'y' to add the Depreciation Schedule attribute for this record

Dept - Department name for this asset. Entries must exactly match the name value from the Departments (DEPT) rule.

BasedOn - Item code that the asset records is based on. Must be an existing item code from Item Master.

*TagID - Asset Tag ID (30 characters max, alphanumeric)

*Serial - Serial Number 1 for the asset (30 characters max, alphanumeric). If no serial number is available, copy the TagID value to this column.

*Name - Asset Name (30 characters max, alphanumeric)

Descrip - Longer description of asset (240 characters max)

EntryDate - Asset Entry Date value. Must be formatted as a date in MM/DD/YY format.

SvrDate - Asset In-Service Date value. Must be formatted as a date in MM/DD/YY format.

Life - This field is not in use

SubLoct - SubLoaction additional details (50 characters max)

RFID - RFID tracking code value (30 characters max, alphanumeric)

CType - Asset Type code from the Asset Type (ASSETTYPE) rule

Route1 - Optional workflow route name from the Route Maintenance screen

Route2 - Optional workflow route name from the Route Maintenance screen

Route3 - Optional workflow route name from the Route Maintenance screen

Route4 - Optional workflow route name from the Route Maintenance screen

FedLife - Federal Depreciation Life/Period in years

FedCost - Federal Asset Cost in dollars, two decimals allowed

FedSalvage - Federal Salvage value in dollars, two decimals allowed

FedMeth - Federal Depreciation Method code. Valid entries are 'SL', 'DB200', 'DB150', 'SY', and 'CDB'. SL = Straight LIne. DB200 = Double Declining Balance 2X. DB150 = Double Declining Balance 1.5X. SY = Sum of Years Digits.

FedConv - Federal Depreciation Table Convention. Valid entries are 'Half-Year', 'Quarter', 'Mid Month', and 'Full Month'.

STLife - State Depreciation Life/Period in years

STCost - State Asset Cost in dollars, two decimals allowed

STSalvage - State Salvage value in dollars, two decimals allowed

STMeth - State Depreciation Method code. Valid entries are 'SL', 'DB200', 'DB150', 'SY', and 'CDB'. SL = Straight LIne. DB200 = Double Declining Balance 2X. DB150 = Double Declining Balance 1.5X. SY = Sum of Years Digits.

STConv - State Minimum Tax Depreciation Table Convention. Valid entries are 'Half-Year', 'Quarter', 'Mid Month', and 'Full Month'.

AMTLife - Alternative Minimum Tax Depreciation Life/Period in years

AMTCost - Alternative Minimum Tax Asset Cost in dollars, two decimals allowed

AMTSalvage - Alternative Minimum Tax Salvage value in dollars, two decimals allowed

AMTMeth - Alternative Minimum Tax Depreciation Method code. Valid entries are 'SL', 'DB200', 'DB150', 'SY', and 'CDB'. SL = Straight LIne. DB200 = Double Declining Balance 2X. DB150 = Double Declining Balance 1.5X. SY = Sum of Years Digits.

AMTConv - Alternative Minimum Tax Depreciation Table Convention. Valid entries are 'Half-Year', 'Quarter', 'Mid Month', and 'Full Month'.

BkLife - Book Depreciation Life/Period in years

BkCost - Book Asset Cost in dollars, two decimals allowed

BkSalvage - Book Salvage value in dollars, two decimals allowed

BkMeth - Book Depreciation Method code. Valid entries are 'SL', 'DB200', 'DB150', 'SY', and 'CDB'. SL = Straight LIne. DB200 = Double Declining Balance 2X. DB150 = Double Declining Balance 1.5X. SY = Sum of Years Digits.

BkConv - Book Depreciation Table Convention. Valid entries are 'Half-Year', 'Quarter', 'Mid Month', and 'Full Month'.

Asset Import Reconciliation

Reconciling imported data should begin with spot-checking several records field-by-field for complete data import. Pick records from the source file that have the most data columns filled in. Verify that all source file data fields imported correctly and display as expected.

Run the Asset Summary report to select the imported records. Review the report for basic details and look for any missing or incorrect records.

Asset Import Additional Steps

There are no additional steps required for the Asset Import

Asset Import Database Tables

RTASSET - Each imported asset creates a new KEYNO in the this table. The TAGID value holds the asset ID value.

ASSETDEP - Asset depreciation control details are imported to this table and assigned a unique keyno for each depreciation type (Federal, State, Book, or AMT). Records are linked to the asset with the ASSETID value that should match the KEYNO value from the RTASSET table.