Item Master Import Guide

From Adjutant Wiki

Contents

General Import Template File Notes

- Template files are typically generated from their respective Import screen using an 'Export Template' button.

- Using the 'Export Template' button from an updated system will help ensure that you are using the most up-to-date import file, and will help avoid errors.

- Templates generally (but not in all cases) contain 3 rows of header information.

- The first row is generally labelled with f1 through f## and is used to give a consistent column id to each data column. Do not remove this row unless instructed.

- The second row is labelled with the column data/field name. The values in this row are used for the file mapping screen. Editing these values is generally not needed and may make the field mapping process difficult.

- The third row (if present) is labelled either with the same values from row 2, or with more detailed field descriptions. The third row is available to create a customer-friendly name for the associated data column.

- The third row should be removed from the source file prior to importing. It will cause errors since it will be treated as the first import record on the file.

- Import files MUST always be saved as 'Microsoft Excel 5.0/95 Workbook (*.xls)' format until further notice. The import screens will generate errors if the file type is not correct.

- It is a good idea to perform a Mapping Table Import using a current source list before beginning on any imports. Without a current mapping table, the quality of imports can be compromised. The Mapping Table Import only needs to be run once on a newly set up Adjutant system. It does not need to be run before each import.

- Export a current list from the Mapping Table Import screen from an updated system (or contact your Implementation Consultant for an updated file).

- Perform a Mapping Table Import on the target system with the XLS file from the step above.

Item Master Import Notes

Timing and Preparation

The Item Master Import should occur early in the setup process, because item records are essential for setup testing, training, and user testing in most of the applications. The Item Control rules should be complete prior to importing. The Item Control Setup Guide covers all of the Rule Maintenance records that should be completed prior to importing item master records.

Item Master import files are commonly separated into multiple imports based on item type, department, category, or any number of item grouping details. Item Department is a common file grouping, because if the import files are separated by department, it is easy to assign the correct department attributes during the import.

Separating the import files by item type can also help with completing the required unit of measure values in the file. Customer item control data generally does not have the same level of unit related fields as Adjutant, and there may be many blank unit related columns that must be completed prior to importing.

The Item Master import is just the first step in building a complete inventory system. There are multiple other imports required to complete setting up the Item Control records. These other imports, such as quantities, cost tiers, coil inventory, configurations, and bills of material, require that the base item record is created first, and should be completed soon after the Item Master import.

The Item Master import does not generally need to be run again as a go-live import. Once the base item records are imported and all items are represented, there is generally no need to re-import.

Occasionally, additional item records must be created in order to accomodate a new selling or production procedure, or accomodate a shift in processes due to difference between a legacy system and Adjutant. When creating new item records for these types of situations, be sure to complete any other required imports for the new item codes.

General Notes

OHF Records If you are importing items for a single warehouse/single owner location, the Item Master import can build the default OHF records automatically. If you are importing for a multi-warehouse and/or multi-owner locations, and ALL imported items on the file are valid for ALL OHF combinations, the Item Master import can also automatically build the needed OHF records for all combinations. If some items are exclusive to certain OHF records, it may be easiest to handle this with separate Item Master import files. Or, depending on the situation, you may be able to use the Item Import (DET) file, also known as the Min/Max file to create the needed OHF combinations.

Item Attributes The Item Master import can automatically create the Catch Weight attribute if the CW columns is 'Y' and the related CW columns are filled in. It will also create the Coil Lot (Coil Receipt Defaults) attribute if the Lot column is 'Y'.

Another reason to consider separating the import files is automatically apply other attributes to certain item types during import. For example, the Buyout, Purchase in QuickBuy, Warning Note, and other special attributes can be auto-assigned to every item on the import if the attribute is flagged during the import. To set an attribute as available in the Item Master import, set the 'Show in Import' (Logic2) option in the Item Attributes (ITEMATTRIB) rule.

Item Master Import File Data Scrubbing

Every customer's data will have different issues that need addressing. Some of the issues will not make themselves visible until after the data has been imported and is in use during parallel testing. This is why it is critically important to perform an early import, and keep accurate notes on issues that need to be addressed on a supplemental import, or for a complete re-import. Some common things that need attention during Item Master data scrubbing include:

- Units - It is common for customer item data to only include a single unit of measure value for each item. Review all item import files carefully and fill in any required unit fields with the correct unit of measure for the different transaction types (purchase, stock, sell). Setting up items with the wrong units can have dramatic effects on costing, GL postings, and other transactions throughout Adjutant. Review the unit details carefully with the customer before importing. It can be difficult to correct unit-related issues after item records have been used.

- Cost - Verify that the current cost is entered in the AvgCost column for each item. Also make sure the stock unit of measure relates to the AvgCost value, because it will default to use the stock unit for the AvgCost. When imported, it sets the correct cost for the item for sales orders and purchase orders.

- Unit Weights - Unit weight can be critically important throughout multiple Adjutant systems and processes such as production and shipping. It is best practices to make sure that all sold items have a unit weight that corresponds to the stock unit imported.

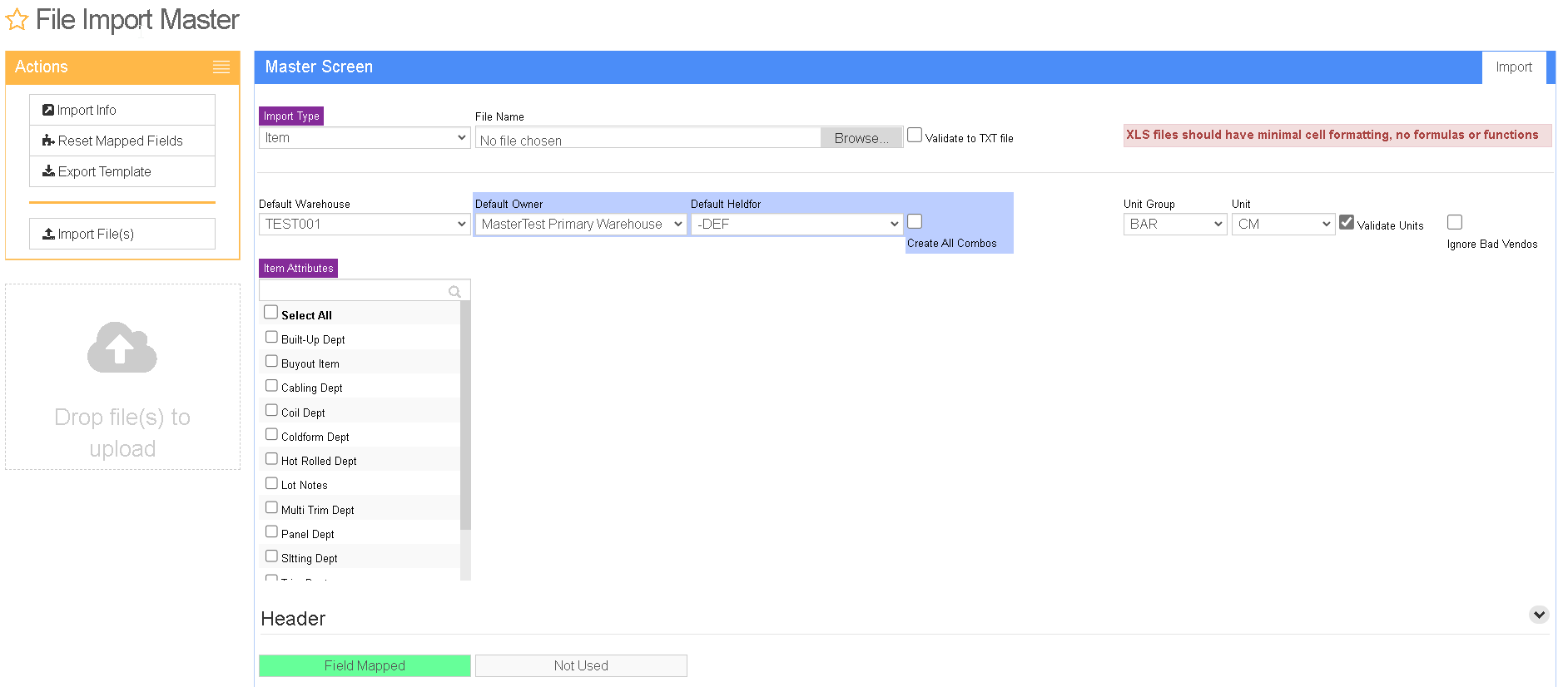

Item Master Import Screen (ITEMIMPORT)

Menu Location: Transaction>>Importers/Exporters>>Item Control>>Item Master Import

File Name(Header)/Browse: Use the Browse button to locate and select the completed Item Master import template file (in XLS format).

Export Template: Generates a blank Item Master import template file

Map Fields: Fields must be mapped prior to importing. If no changes have been made to the column headings, the mapping screen should show all green, and you can click OK to continue. If any of the Input Field Name columns on the left are red, single-click on the line on the left column, and then double-click the desired mapped field in the right column to complete the mapping. Repeat for any red lines on the left that should be mapped. If there are additional columns in the source file that should NOT be mapped, they can be left unmapped (displayed in red). Mandatory fields will require that they be mapped before clicking OK.

Default Warehouse: Sets the warehouse location for any imported items where the WHSE column on the import file is left blank. This list is populated by Warehouse Control records that have been created.

Default Owner: Sets the inventory owner for any imported items where the OWNERID column on the import file is left blank. This list is populated with Organization records that have the Inventory Owner attribute.

Default HedlFor: Sets the inventory holder for any imported items where the HELDFOR column on the import file is left blank. This list is populated from the Item Held For Codes (HOLDER) Rule Maintenance record. If a catch-all code such as 'DEF' is used, make sure the HOLDER rule is set up properly.

Create All Combinations: Selecting this box will create separate OHF (ITEMDET) records for each OHF combination based on the owners and held for records that have been set up.

Unit Group: Sets the unit group for any imported items where the UNITGRP column is left blank

Unit: Sets ALL unit values for any imported items where any unit-related column (PURUNIT, STKUNIT, SELLUNIT, etc) is left blank

Validate Units: Selecting this box will verify that all unit values on the import are valid defined units in the Unit of Measure (UNITS) rule, and that they are valid units for the selected Unit Group. For example, if FT is not defined as a valid unit in the IND Unit Group according to the rule, it will not pass verification.

Ignore Bad Vendnos: Selecting this box will import the VENDNO column data as-is, without verifying that the vendor number exists in Address Book.

Check for Inactive Items: Selecting this box will check all imported item numbers against existing item numbers that have been marked as inactive, and will reject the imported items if there is a match.

Select Attributes: Attributes selected during the import process will be applied to ALL imported items. Review and verify that the attributes are set correctly before each import. Correcting associated attributes can be a complicated process. Attributes show up in this list based on the 'Show on Import' (Logic2) field in the Item Attributes (ITEMATTRIB) Rule Maintenance record.

Item Master Import File Definitions

Required fields are indicated with an *

f1 - Item - Item Code (20 alphanumeric character max, no spaces allowed) f10 - StkFlag - Y if the item is stocked in the warehouse, N if it is not (made to order items are not stocked) f11 - SerialFlag - Y if the item is serialized, N if it is not (serialized items have a serial number for every quantity of 1) f12 - LotFlag - Y if the item is lot controlled, N if it is not (all coils are lot controlled) f13 - Vendno - The vendor code of the item’s default supplier f14 - Vpartno - The default supplier’s item code f15 - HeldFor - Only used in multi-owner warehouses f16 - Owner - Same as above f17 - Whse - Enter the code of one of your warehouses (HOUSTON for example) f18 - Taxable - Y if the item is taxable, N if it is not f19 - UnitW - The item’s unit weight per stocking unit f2 - Descrip - Item Description (99 alphanumeric character max) f20 - Cubes - Used in Warehouse Mgmt System shipping (leave blank) f21 - DecQty - The number of decimals that should be available when entering quantities of the item on a purchase or sales order f22 - MiscItem - Y if the item is miscellaneous, N if it is not f23 - Class - Free-text field where you can enter anything you want (leave blank) f24 - Resell - Y if you plan on selling this item, N if you do not f25 - PackCode - Leave blank f26 - ABCCode - Leave blank f27 - Pgroup - The item’s pricing group (customer pricing may be broken into item pricing groups; e.g. customer XYZ gets 40% off PANELS, 50% off COLDFORM, and 30% off ACCESSORIES; applicable in component sales) f28 - ComCode - The item’s commodity code (commodity codes are used in procurement and determine which suppliers can bid on which items; enter TBD if you need to) f29 - BaseCost - The item’s base cost (if you are pricing your items using a cost-plus scheme) f3 - UnitGrp - Item Unit of Measure Group (examples are LENGTH, WEIGHT, TIME, IND). Must match a value in the UNITS rule. f30 - ProdLine - Leave blank f31 - ProdGrp - Item’s product group enter one of the following in the column; M,L,E,X,S (all items fit into one of 5 categories - Material, Labor, Equipment, Expense, or Subcontract) f32 - *ItemCat - Item’s transaction category (transaction categories are used to drive revenue and cost to the correct GL account; enter DEF here until the chart of accounts is set up) If left blank, the item record will not be usable until the category is filled in. f33 - SqFt - The items square footage per stocking unit f34 - WarLen - If the item has an associated warranty length, enter it here f35 - Produce - Y if the item is produced in the plant, N if the item is not produced f36 - SearchCode - Leave blank f37 - StdCost - Item’s standard cost per pricing unit f38 - Coil - Y if the item is a coil. f39 - CW - Y if the item is a catch-weight item. f4 - PurUnit - Item purchase unit f40 - CWPurCon - Catch-Weight conversion factor between stock unit and purchase unit f41 - CWSellConv - Catch-Weight conversion factor between stock unit and selling unit. f42 - CWSPriceConv - Catch-Weight conversion factor between stock unit and pricing unit. f43 - CWSTKConv - Catch-Weight conversion factor between catch unit and stock unit. f44 - CWUnit - Catch-Weight Unit. f45 - MasterTrack - Y if item is lot controlled AND needs to be tracked by P-number. This is typically used if you need to individually track multiple lots that have the same lot number. f5 - StkUnit - Item stocking unit f6 - SellUnit - Item sell unit f7 - AvgCost - Item’s current average cost per stocking unit f8 - Price - Item’s price per pricing unit f9 - PriceUnit - Item’s pricing unit

*f1 - Item - Item number/code (20 character max, alphanumeric, no spaces allowed). The following special characters are allowed (. - + / _)

*f2 - Descrip -

Item - Item Code (20 alphanumeric character max, no spaces allowed)

Descrip - Item Description (99 alphanumeric character max)

UnitGrp - Item Unit of Measure Group (examples are LENGTH, WEIGHT, TIME, IND). Must match a value in the UNITS rule.

PurUnit: Item purchase unit

StkUnit: Item stocking unit

SellUnit: Item sell unit

AvgCost: Item’s current average cost per stocking unit

Price: Item’s price per pricing unit

PriceUnit: Item’s pricing unit

StkFlag: Y if the item is stocked in the warehouse, N if it is not (made to order items are not stocked)

SerialFlag: Y if the item is serialized, N if it is not (serialized items have a serial number for every quantity of 1)

LotFlag: Y if the item is lot controlled, N if it is not (all coils are lot controlled)

Vendno: The vendor code of the item’s default supplier

Vpartno: The default supplier’s item code

HeldFor: Only used in multi-owner warehouses

Owner: Same as above

Whse: Enter the code of one of your warehouses (HOUSTON for example)

Taxable: Y if the item is taxable, N if it is not

UnitW: The item’s unit weight per stocking unit

Cubes: Used in Warehouse Mgmt System shipping (leave blank)

DecQty: The number of decimals that should be available when entering quantities of the item on a purchase or sales order

MiscItem: Y if the item is miscellaneous, N if it is not

Class: Free-text field where you can enter anything you want (leave blank)

Resell: Y if you plan on selling this item, N if you do not

PackCode: Leave blank

ABCCode: Leave blank

Pgroup: The item’s pricing group (customer pricing may be broken into item pricing groups; e.g. customer XYZ gets 40% off PANELS, 50% off COLDFORM, and 30% off ACCESSORIES; applicable in component sales)

ComCode: The item’s commodity code (commodity codes are used in procurement and determine which suppliers can bid on which items; enter TBD if you need to)

BaseCost: The item’s base cost (if you are pricing your items using a cost-plus scheme)

ProdLine: Leave blank

ProdGrp: Item’s product group enter one of the following in the column; M,L,E,X,S (all items fit into one of 5 categories: Material, Labor, Equipment, Expense, or Subcontract)

- ItemCat: Item’s transaction category (transaction categories are used to drive revenue and cost to the correct GL account; enter DEF here until the chart of accounts is set up) If left blank, the item record will not be usable until the category is filled in.

SqFt: The items square footage per stocking unit

WarLen: If the item has an associated warranty length, enter it here

Produce: Y if the item is produced in the plant, N if the item is not produced

SearchCode: Leave blank

StdCost: Item’s standard cost per pricing unit

Coil: Y if the item is a coil.

CW: Y if the item is a catch-weight item.

CWPurCon: Catch-Weight conversion factor between stock unit and purchase unit

CWSellConv: Catch-Weight conversion factor between stock unit and selling unit.

CWSPriceConv: Catch-Weight conversion factor between stock unit and pricing unit.

CWSTKConv: Catch-Weight conversion factor between catch unit and stock unit.

CWUnit: Catch-Weight Unit.

MasterTrack: Y if item is lot controlled AND needs to be tracked by P-number. This is typically used if you need to individually track multiple lots that have the same lot number. Bill To customer number in Adjutant

f3 - TranDate - Transaction Date (MM/DD/YYYY). Used for report selects to differentiate between the GL posting date and the receipt date.

*f4 - PostDate - Postmark or Posted date (MM/DD/YYYY)

*f5 - CashAmt - Dollar amount of cash received

*f6 - RefNo - Reference number or check number

*f7 - CashAcct - Cash GL account, typically a banking account, deposit account, or other cash account

f8 - AdjAmt - Dollar amount of invoice adjustment. This is added to the cash amount value to calculate total payment.

f9 - DiscAmt - Dollar amount of invoice discount. This is added to the cash amount value to calculate total payment.

f10 - Deposit - Enter Y to flag this receipt as a deposit. The invoice number should be blank. If the invoice number is blank and the deposit flag is blank, the record will be imported as an open credit.

f11 - BankDepNum - Bank deposit number. This is used to group and sort Cash Receipts reporting, as well as Bank Reconciliation.

f12 - ClearDate - Bank Reconciliation cleared date. If a date is filled in, the record will be marked as cleared in Bank Reconciliation.

f13 - SNote - Cash Receipt note

f14 - CRTtype - Cash Receipt Type. Valid Cash Receipt type names from the CASHRECTYPE rule should be used.

Item - Item Code (20 alphanumeric character max, no spaces allowed)

Descrip - Item Description (99 alphanumeric character max)

UnitGrp - Item Unit of Measure Group (examples are LENGTH, WEIGHT, TIME, IND). Must match a value in the UNITS rule.

PurUnit: Item purchase unit

StkUnit: Item stocking unit

SellUnit: Item sell unit

AvgCost: Item’s current average cost per stocking unit

Price: Item’s price per pricing unit

PriceUnit: Item’s pricing unit

StkFlag: Y if the item is stocked in the warehouse, N if it is not (made to order items are not stocked)

SerialFlag: Y if the item is serialized, N if it is not (serialized items have a serial number for every quantity of 1)

LotFlag: Y if the item is lot controlled, N if it is not (all coils are lot controlled)

Vendno: The vendor code of the item’s default supplier

Vpartno: The default supplier’s item code

HeldFor: Only used in multi-owner warehouses

Owner: Same as above

Whse: Enter the code of one of your warehouses (HOUSTON for example)

Taxable: Y if the item is taxable, N if it is not

UnitW: The item’s unit weight per stocking unit

Cubes: Used in Warehouse Mgmt System shipping (leave blank)

DecQty: The number of decimals that should be available when entering quantities of the item on a purchase or sales order

MiscItem: Y if the item is miscellaneous, N if it is not

Class: Free-text field where you can enter anything you want (leave blank)

Resell: Y if you plan on selling this item, N if you do not

PackCode: Leave blank

ABCCode: Leave blank

Pgroup: The item’s pricing group (customer pricing may be broken into item pricing groups; e.g. customer XYZ gets 40% off PANELS, 50% off COLDFORM, and 30% off ACCESSORIES; applicable in component sales)

ComCode: The item’s commodity code (commodity codes are used in procurement and determine which suppliers can bid on which items; enter TBD if you need to)

BaseCost: The item’s base cost (if you are pricing your items using a cost-plus scheme)

ProdLine: Leave blank

ProdGrp: Item’s product group enter one of the following in the column; M,L,E,X,S (all items fit into one of 5 categories: Material, Labor, Equipment, Expense, or Subcontract)

- ItemCat: Item’s transaction category (transaction categories are used to drive revenue and cost to the correct GL account; enter DEF here until the chart of accounts is set up) If left blank, the item record will not be usable until the category is filled in.

SqFt: The items square footage per stocking unit

WarLen: If the item has an associated warranty length, enter it here

Produce: Y if the item is produced in the plant, N if the item is not produced

SearchCode: Leave blank

StdCost: Item’s standard cost per pricing unit

Coil: Y if the item is a coil.

CW: Y if the item is a catch-weight item.

CWPurCon: Catch-Weight conversion factor between stock unit and purchase unit

CWSellConv: Catch-Weight conversion factor between stock unit and selling unit.

CWSPriceConv: Catch-Weight conversion factor between stock unit and pricing unit.

CWSTKConv: Catch-Weight conversion factor between catch unit and stock unit.

CWUnit: Catch-Weight Unit.

MasterTrack: Y if item is lot controlled AND needs to be tracked by P-number. This is typically used if you need to individually track multiple lots that have the same lot number.

Cash Receipt Import Reconciliation

Reconciling imported data should begin with spot-checking several records field-by-field for complete data import. Pick records from the source file that have the most data columns filled in. Verify that all source file data fields imported correctly and display as expected.

Run the AR Cash Receipts Report and verify that the imported receipts are reported as expected under the correct customer records. Compare the report totals against the total dollars on the import file for cash amount, discount, and adjustment totals. Verify the amounts total correctly by cash GL account.

Review several AR invoices and verify that the imported cash receipts show up as payments against the corresponding invoices.

Run the AR Aging with Payments Report and verify that receipts and adjustments show up on the report as expected.

Cash Receipt Import Additional Steps

If using Bank Reconciliation, review Bank Rec for the imported transactions. Reconcile or adjust the imported receipts as needed.

Cash Receipt Import Database Tables

CASHREC - Each imported receipt creates a new KEYNO in the CASHREC table. The customer number will show in the PAYEE field as the ENTID. If the receipt is linked to an invoice record, the link will be in the BILLH field which matches the invoice KEYNO from the BILLMAST table.