Difference between revisions of "AR Invoice Master"

From Adjutant Wiki

| Line 16: | Line 16: | ||

'''Unique Actions''' | '''Unique Actions''' | ||

| − | :''' | + | :'''Edit AR Invoice''' Edit the AR Invoice. |

| − | |||

| − | |||

:'''Issue Credit for Invoice Action''' Issue a credit to the invoice for any reason and regardless of payments received. | :'''Issue Credit for Invoice Action''' Issue a credit to the invoice for any reason and regardless of payments received. | ||

| − | |||

::1. Enter the invoice number and press Enter. | ::1. Enter the invoice number and press Enter. | ||

| Line 33: | Line 30: | ||

::6. Click Yes to '''Apply the Credit to the Original Invoice'''. | ::6. Click Yes to '''Apply the Credit to the Original Invoice'''. | ||

| − | ::*NOTE: If you click '''No''' here, you'll have to manually apply the credit to the original invoice in order to set the balance to zero. You almost always want to click '''Yes''' to this question | + | ::*'''NOTE:''' If you click '''No''' here, you'll have to manually apply the credit to the original invoice in order to set the balance to zero. You almost always want to click '''Yes''' to this question. |

| − | |||

| − | |||

| − | |||

| − | |||

:'''Show Notes''' Click to open the notes vault for the selected invoice. | :'''Show Notes''' Click to open the notes vault for the selected invoice. | ||

| Line 47: | Line 40: | ||

:'''Pay With Credit Card''' Click the Credit Card icon to process a credit card transaction for the invoice. An integrated credit card processing software package is required. This screen can also be used to pay with Cash, Check, Other source of money, or mark NSF (insufficient funds). | :'''Pay With Credit Card''' Click the Credit Card icon to process a credit card transaction for the invoice. An integrated credit card processing software package is required. This screen can also be used to pay with Cash, Check, Other source of money, or mark NSF (insufficient funds). | ||

| − | :'''Create Tax Credit''' | + | :'''Create Tax Credit''' Issue a sales tax credit for this invoice. |

| − | :*'''NOTE:''' The Taxable Sales Amount that is reported on the Sales Tax Due report will not be changed by a Tax Credit. Credit the entire invoice and reissue it with the correct tax rate in order to change the taxable sales amount. | + | ::1. Select to launch the '''Create Tax Credit''' pop-up window. |

| + | ::2. Complete '''Credit Amount''', '''Credit Date''' and '''Tax Table''' fields. | ||

| + | ::3. Check the box next to '''Apply to Invoice'''. | ||

| + | ::4. Click '''Create Credit''' to accomplish action and close window. | ||

| + | ::*'''NOTE:''' The Taxable Sales Amount that is reported on the Sales Tax Due report will not be changed by a Tax Credit. Credit the entire invoice and reissue it with the correct tax rate in order to change the taxable sales amount. | ||

:'''Capture Signature''' This will open a screen to capture a signature using Topaz signature pads. Once the signature is captured it can be printed on the invoice form. Proper Topaz drivers must be installed to use this functionality. | :'''Capture Signature''' This will open a screen to capture a signature using Topaz signature pads. Once the signature is captured it can be printed on the invoice form. Proper Topaz drivers must be installed to use this functionality. | ||

Revision as of 15:22, 12 December 2022

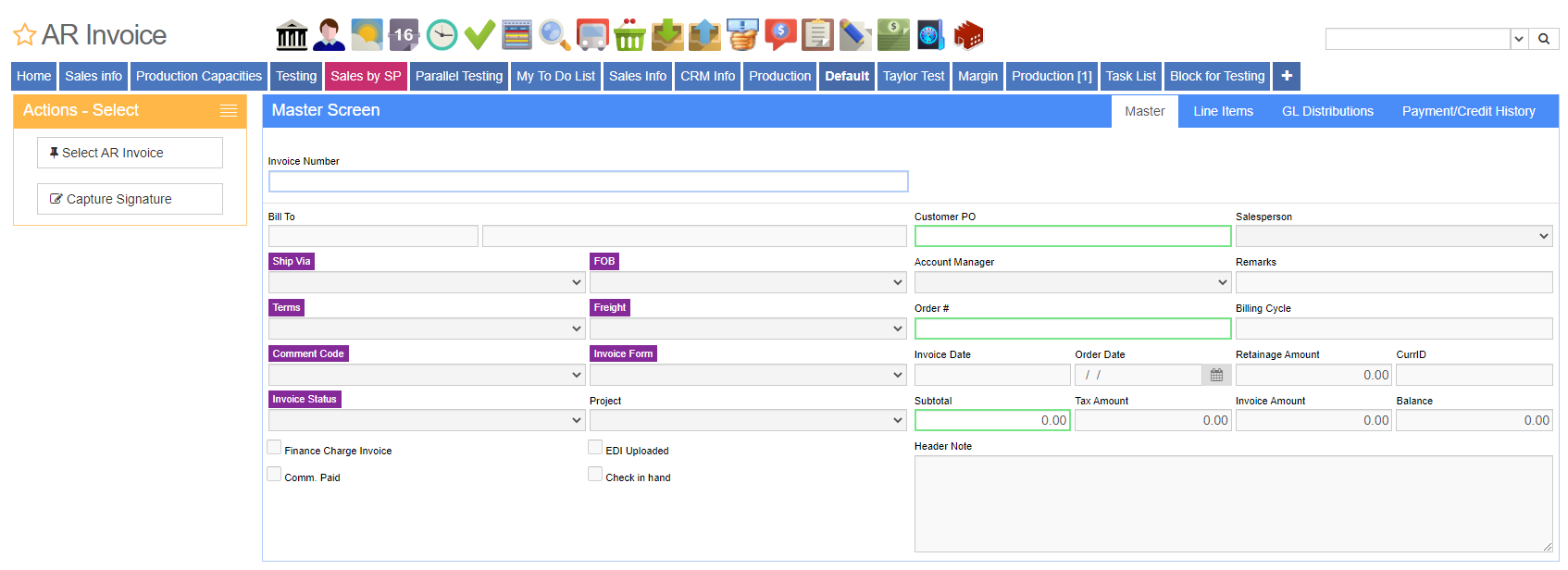

General Description

How to Access

- URL ArInvMaster_S.htm

- Menu Location Transaction >> Accounts Receivable >> AR Invoice Master

Function The AR Invoice screen can be used to view a customer invoice, edit Header information, credit unpaid invoices, issue tax credits, issue refunds, pay by credit card, and print invoices.

Master Screen Tabs

Master

View and edit accounts receivable invoices.

Unique Actions

- Edit AR Invoice Edit the AR Invoice.

- Issue Credit for Invoice Action Issue a credit to the invoice for any reason and regardless of payments received.

- 1. Enter the invoice number and press Enter.

- 2. Click the Issue Credit for Invoice button.

- 3. Click Yes when asked if you want to Issue Credit and Unship/Bill.

- 4. Enter a Credit Memo Date and press Approve. It will default to today's date.

- 5. Click Yes if you want to Reopen the Sales Order on the voided invoice.

- 6. Click Yes to Apply the Credit to the Original Invoice.

- NOTE: If you click No here, you'll have to manually apply the credit to the original invoice in order to set the balance to zero. You almost always want to click Yes to this question.

- 6. Click Yes to Apply the Credit to the Original Invoice.

- Show Notes Click to open the notes vault for the selected invoice.

- Linked Documents Click to open the documents vault for the selected invoice.

- Select AR Invoice Click to selects a different AR Invoice.

- Pay With Credit Card Click the Credit Card icon to process a credit card transaction for the invoice. An integrated credit card processing software package is required. This screen can also be used to pay with Cash, Check, Other source of money, or mark NSF (insufficient funds).

- Create Tax Credit Issue a sales tax credit for this invoice.

- 1. Select to launch the Create Tax Credit pop-up window.

- 2. Complete Credit Amount, Credit Date and Tax Table fields.

- 3. Check the box next to Apply to Invoice.

- 4. Click Create Credit to accomplish action and close window.

- NOTE: The Taxable Sales Amount that is reported on the Sales Tax Due report will not be changed by a Tax Credit. Credit the entire invoice and reissue it with the correct tax rate in order to change the taxable sales amount.

- Capture Signature This will open a screen to capture a signature using Topaz signature pads. Once the signature is captured it can be printed on the invoice form. Proper Topaz drivers must be installed to use this functionality.

Fields/Filters

- Bill To The customer being billed for this invoice (You cannot edit this field!)

- Ship Via Shipping Method

- FOB FOB terms

- Terms Payment Terms

- Freight Freight terms

- Comment Code Customer Comment

- Invoice Form Select the form for the invoice.

- Invoice Status Select the status for the invoice.

- Project Linked Project. Field is populated from linked Project on Sales Order or service order.

- Customer PO Customer purchase order number

- Salesperson Salesperson from the SO.

- Account Manager Account Manager from the SO.

- Remarks Remarks field (free text). Carried over from the SO that was invoiced.

- Order # Sales/Service Order number

- Billing Cycle Billing cycle that was entered when creating the invoice (Time Billing only).

- Using the Edit AR Inv action, this field can be used to change the invoice billing cycle by clicking in the field and entering the correct month and year for the invoice.

- Invoice Date Invoice Date.

- Order Date Entry date of the Sales Order

- Subtotal The amount on the invoice before tax.

- Tax Amount The tax amount for the invoice.

- Invoice Amount The total amount on the invoice.

- Balance The unpaid amount on the invoice.

- Header Note A note that appears on the invoice (Click Edit to change)

Line Items

If you want to edit the original sales order on the invoice, you can navigate to that sales order in the Line Items tab by clicking the SO#. The SO will be open and unshipped, and you can edit anything you like.

GL Distributions

Payment/Credit History

FAQ

Q: How do I issue a credit for part of an invoice?

A: Enter a new Sales Order (using the appropriate SO Type and line item(s)) and then ship/invoice the credit amount.

Q: Can you search by Customer PO?

A: Yes, click the Select button to enable the Customer PO field for search. You can also search by Sales Order number and Invoice Amount.

Q: I created an Invoice, but the GL Distributions tab is blank. What's wrong?

A: You need to generate a batch in order for the invoice to create the GL Distributions.

Q: There are line items on the invoice, but nothing prints. What's wrong?

A: Most likely, the line items on the invoice are hidden. Click the "Print All Lines" button or check the "Show Hidden Lines" box when printing.