Difference between revisions of "Sales Tax Due"

From Adjutant Wiki

(Created page with "__NOTOC__ ==General Information== '''Default Menu Location''' Reports >> Sales Tax >> Sales Tax Due '''Screen Name''' SALESTAXDUE '''Function''' The Sales Tax Due repor...") |

|||

| Line 8: | Line 8: | ||

'''Function''' The Sales Tax Due report is used to determine the amount to pay taxing authorities for sales made within a given period. | '''Function''' The Sales Tax Due report is used to determine the amount to pay taxing authorities for sales made within a given period. | ||

| + | |||

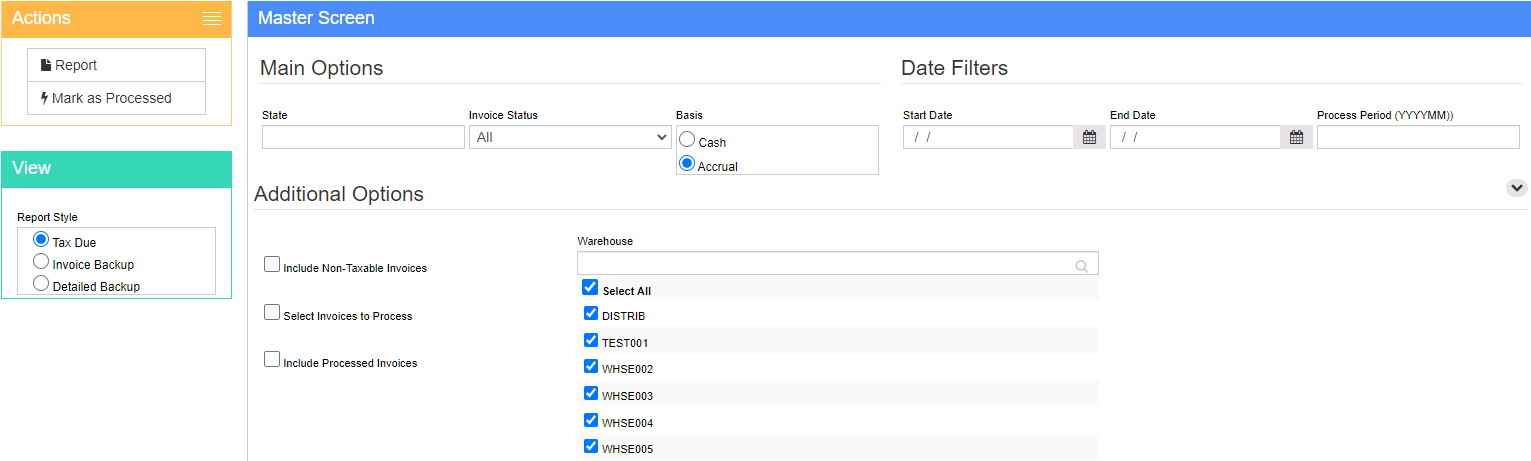

| + | [[File: Sales_Tax_Due_Report_Screen.png]] | ||

| + | |||

==Fields/Filters== | ==Fields/Filters== | ||

'''Basis:''' Determines when the tax is considered due | '''Basis:''' Determines when the tax is considered due | ||

| − | |||

* '''Cash:''' Sales tax is considered due upon receipt of payment (cash receipt). Tax is only considered due when the invoice has been fully paid (has a zero balance). | * '''Cash:''' Sales tax is considered due upon receipt of payment (cash receipt). Tax is only considered due when the invoice has been fully paid (has a zero balance). | ||

* '''Accrual:''' Sales tax is considered due when the sales order is invoiced (shipped) | * '''Accrual:''' Sales tax is considered due when the sales order is invoiced (shipped) | ||

Revision as of 12:51, 9 September 2022

General Information

Default Menu Location Reports >> Sales Tax >> Sales Tax Due

Screen Name SALESTAXDUE

Function The Sales Tax Due report is used to determine the amount to pay taxing authorities for sales made within a given period.

Fields/Filters

Basis: Determines when the tax is considered due

- Cash: Sales tax is considered due upon receipt of payment (cash receipt). Tax is only considered due when the invoice has been fully paid (has a zero balance).

- Accrual: Sales tax is considered due when the sales order is invoiced (shipped)

- Select Invoices to Process: When checked, allows the user to individually select which invoices they would like to mark as processed for that process period.