Difference between revisions of "Sales Tax Due"

From Adjutant Wiki

| Line 5: | Line 5: | ||

'''Default Menu Location''' Reports >> Sales Tax >> Sales Tax Due | '''Default Menu Location''' Reports >> Sales Tax >> Sales Tax Due | ||

| − | ''' | + | '''URL''' SalesTaxDue_S.htm |

'''Function''' The Sales Tax Due report is used to determine the amount to pay taxing authorities for sales made within a given period. | '''Function''' The Sales Tax Due report is used to determine the amount to pay taxing authorities for sales made within a given period. | ||

| Line 17: | Line 17: | ||

* '''Cash:''' Sales tax is considered due upon receipt of payment (cash receipt). Tax is only considered due when the invoice has been fully paid (has a zero balance). | * '''Cash:''' Sales tax is considered due upon receipt of payment (cash receipt). Tax is only considered due when the invoice has been fully paid (has a zero balance). | ||

* '''Accrual:''' Sales tax is considered due when the sales order is invoiced (shipped) | * '''Accrual:''' Sales tax is considered due when the sales order is invoiced (shipped) | ||

| − | * '''Select Invoices to Process:''' When checked, allows the user to individually select which invoices they would like to mark as processed for that process period. | + | * '''Select Invoices to Process:''' When checked, allows the user to individually select which invoices they would like to mark as processed for that process period. |

| − | [[Category: Accounts Receivable]] | + | =Standard Report Fields(Page Header)== |

| − | [[Category: Sales Tax]] | + | |

| + | '''Company''' | ||

| + | |||

| + | * company | ||

| + | |||

| + | '''Date Range''' | ||

| + | |||

| + | * "Date Range:" + dtoc(ld_sdate) + " to " + dtoc(ld_edate) | ||

| + | |||

| + | ===Group Header 1: State Name=== | ||

| + | |||

| + | '''State''' | ||

| + | |||

| + | * stname | ||

| + | |||

| + | ===Group Header 2: Tax Type=== | ||

| + | |||

| + | '''Tax Jurisdiction''' | ||

| + | |||

| + | * taxtype | ||

| + | |||

| + | ==Standard Report Fields(Details)== | ||

| + | |||

| + | '''Tax''' | ||

| + | |||

| + | * alltrim(taxname)+"-"+alltrim(taxname2) | ||

| + | |||

| + | '''Non Taxable Amt''' | ||

| + | |||

| + | * nontaxamt | ||

| + | |||

| + | '''Taxable Amt''' | ||

| + | |||

| + | * amount | ||

| + | |||

| + | '''Taxrate''' | ||

| + | |||

| + | * taxrate | ||

| + | |||

| + | '''Tax Due''' | ||

| + | |||

| + | * taxamt | ||

| + | |||

| + | ===Group Footer 2: Tax Type=== | ||

| + | |||

| + | '''Taxrate''' | ||

| + | |||

| + | * taxrate | ||

| + | |||

| + | '''Tax Due''' | ||

| + | |||

| + | * taxamt | ||

| + | |||

| + | ===Group Footer 1: State Name=== | ||

| + | |||

| + | '''State Name''' | ||

| + | |||

| + | * stname | ||

| + | |||

| + | '''Tax Due''' | ||

| + | |||

| + | * taxamt | ||

| + | |||

| + | ==Summary== | ||

| + | |||

| + | '''Non Tax Amt''' | ||

| + | |||

| + | * nontaxtot | ||

| + | |||

| + | '''TaxableAmt''' | ||

| + | |||

| + | * taxtot | ||

| + | |||

| + | '''Tax Due''' | ||

| + | |||

| + | * taxamt | ||

| + | |||

| + | [[Category:Accounts Receivable]] | ||

| + | [[Category:Sales Tax]] | ||

Latest revision as of 15:20, 9 December 2022

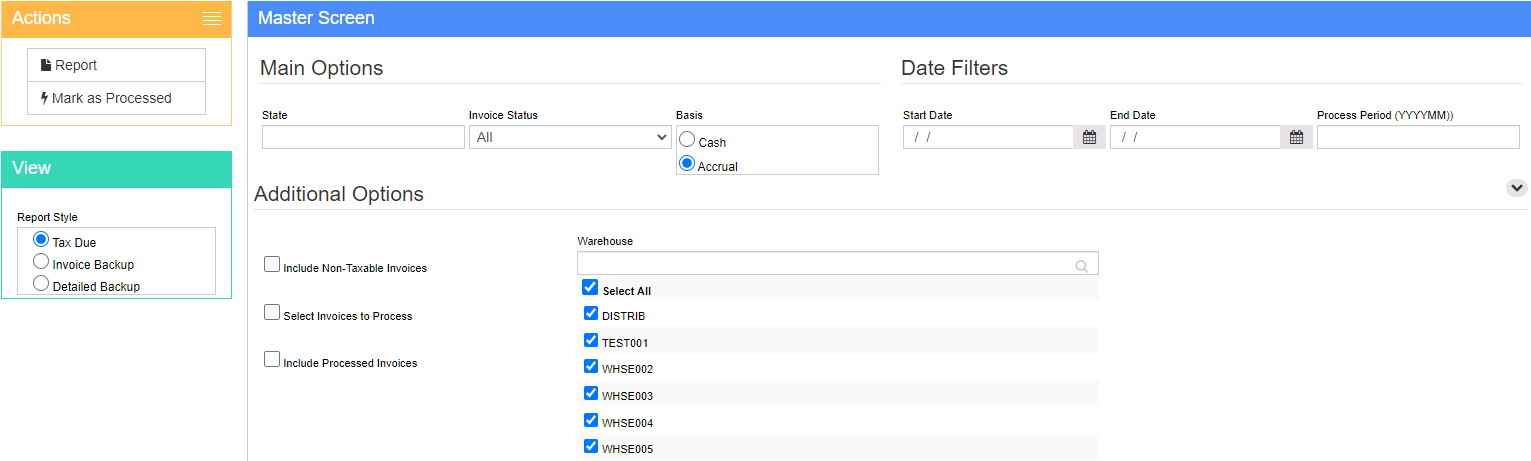

General Information

Default Menu Location Reports >> Sales Tax >> Sales Tax Due

URL SalesTaxDue_S.htm

Function The Sales Tax Due report is used to determine the amount to pay taxing authorities for sales made within a given period.

Fields/Filters

Basis: Determines when the tax is considered due

- Cash: Sales tax is considered due upon receipt of payment (cash receipt). Tax is only considered due when the invoice has been fully paid (has a zero balance).

- Accrual: Sales tax is considered due when the sales order is invoiced (shipped)

- Select Invoices to Process: When checked, allows the user to individually select which invoices they would like to mark as processed for that process period.

Standard Report Fields(Page Header)=

Company

- company

Date Range

- "Date Range:" + dtoc(ld_sdate) + " to " + dtoc(ld_edate)

Group Header 1: State Name

State

- stname

Group Header 2: Tax Type

Tax Jurisdiction

- taxtype

Standard Report Fields(Details)

Tax

- alltrim(taxname)+"-"+alltrim(taxname2)

Non Taxable Amt

- nontaxamt

Taxable Amt

- amount

Taxrate

- taxrate

Tax Due

- taxamt

Taxrate

- taxrate

Tax Due

- taxamt

State Name

- stname

Tax Due

- taxamt

Summary

Non Tax Amt

- nontaxtot

TaxableAmt

- taxtot

Tax Due

- taxamt