Difference between revisions of "Tax Table"

From Adjutant Wiki

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

| + | __NOTOC__ | ||

| + | ===General Information=== | ||

| + | |||

| + | '''Default Menu Location:''' Maintain >> Sales Tax >> Tax Table Master | ||

| + | |||

| + | '''URL:''' TaxTable_S.htm | ||

| + | |||

| + | '''Function:''' The Tax Table Master screen allows users to create and maintain each tax rate record for local, city, county, and state tax amounts, then combine those records to build the tax rates for business location. | ||

| + | |||

| + | [[image:taxtablemst.png]] | ||

| + | |||

| + | ===Fields/ Filters=== | ||

| + | |||

| + | '''Tax Tables:''' Enter the name of the tax table. | ||

| + | |||

| + | '''Tax Rates:''' Enter the rate that will be applied to the tax table. | ||

| + | |||

| + | |||

| + | ===Modifying & Adding Tax Rates=== | ||

| + | |||

| + | ====Updating Tax Table Rate==== | ||

| + | |||

| + | The tax rate is stored on an organization's ShipTo Attribute. | ||

| + | |||

| + | [[image:shiptotaxtable.png]] | ||

| + | |||

| + | |||

| + | The user can get to the tax table master by either clicking on the TaxTable label on the shipto screen or through the menu Maintain>> Sales Tax>> Tax Table Master | ||

| + | |||

| + | Currently the OH tax table (what was used before the subscription) is set up at 7% all under one State rate. To edit this we can either increase the state rate or build a rate for the county, city, zip, etc. | ||

| + | |||

| + | Set up of each rate is on the tax rate tab. Select STATE, Type, then enter the new rate information. | ||

| + | |||

| + | Name must be unique to the state (so it cannot be "OHIO STATE") | ||

| + | Code must not have any spaces min 2 characters | ||

| + | Description is free text | ||

| + | rate is entered as a percentage | ||

| + | effective date for example will be 09/01/13 if the tax takes effect on September 1st. | ||

| + | |||

| + | Once finished and saved we can go back to the OH Tax Tables tab [edit] and select the new tax rate from the drop down either replacing the OHIO STATE rate in the State row or adding it by drop down in the county or city. | ||

| + | |||

| + | Now that we have an updated rate we can to the tax table update screen Maintain>> Sales Tax>> ShipTO/TaxTable Update. Select update and you're done! | ||

| + | |||

| + | [[category:Sales Tax]] | ||

Latest revision as of 15:11, 9 December 2022

General Information

Default Menu Location: Maintain >> Sales Tax >> Tax Table Master

URL: TaxTable_S.htm

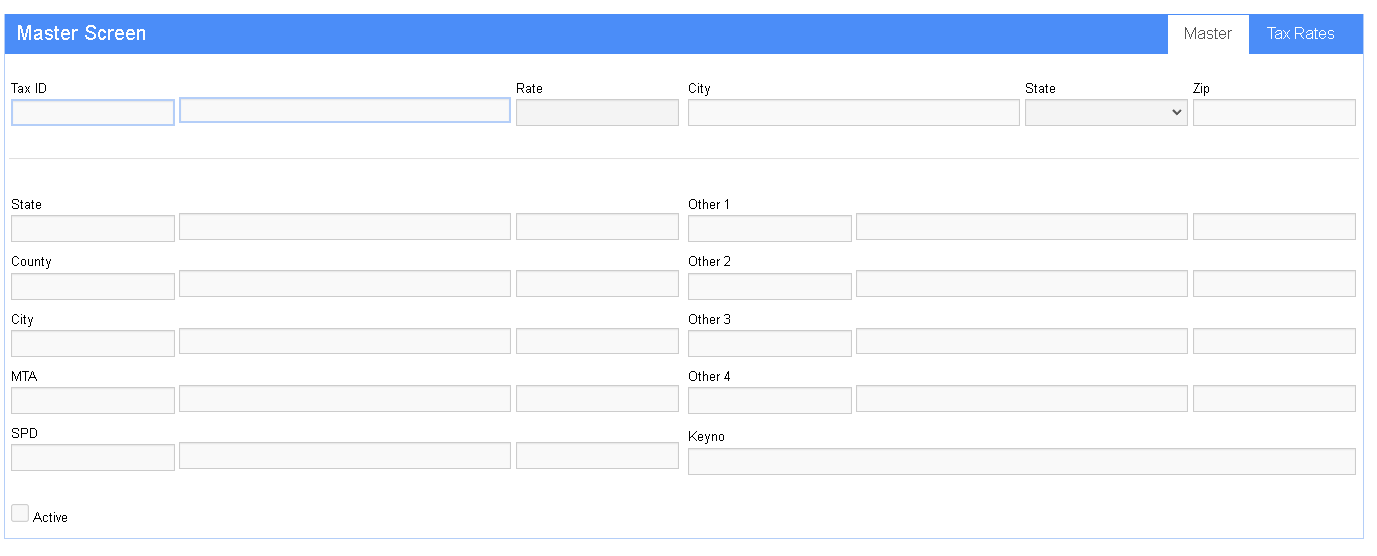

Function: The Tax Table Master screen allows users to create and maintain each tax rate record for local, city, county, and state tax amounts, then combine those records to build the tax rates for business location.

Fields/ Filters

Tax Tables: Enter the name of the tax table.

Tax Rates: Enter the rate that will be applied to the tax table.

Modifying & Adding Tax Rates

Updating Tax Table Rate

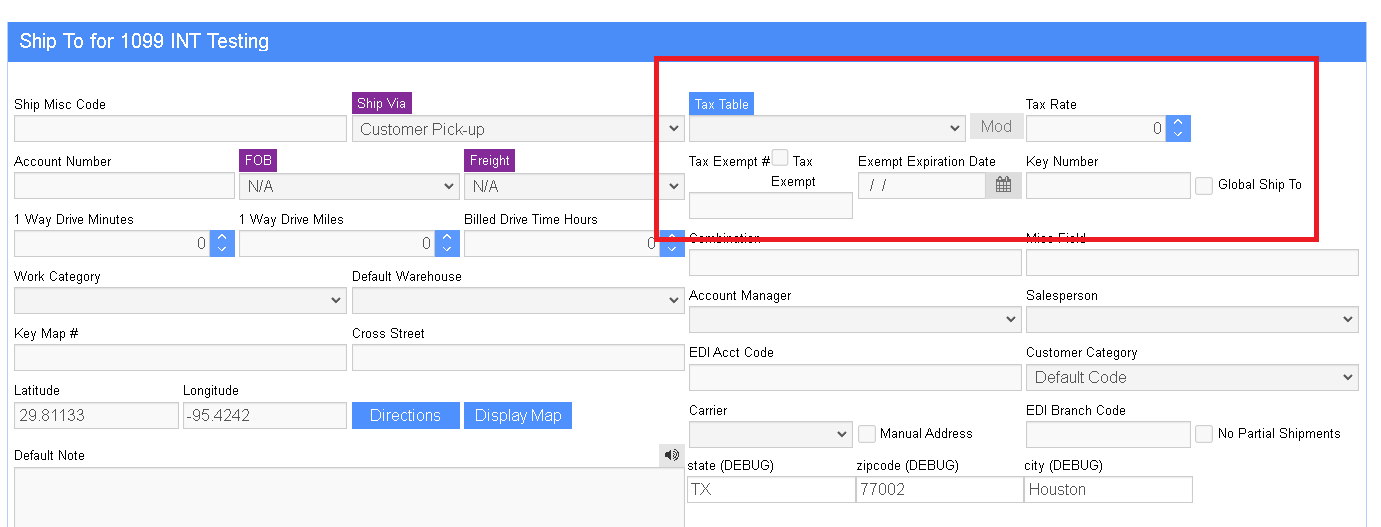

The tax rate is stored on an organization's ShipTo Attribute.

The user can get to the tax table master by either clicking on the TaxTable label on the shipto screen or through the menu Maintain>> Sales Tax>> Tax Table Master

Currently the OH tax table (what was used before the subscription) is set up at 7% all under one State rate. To edit this we can either increase the state rate or build a rate for the county, city, zip, etc.

Set up of each rate is on the tax rate tab. Select STATE, Type, then enter the new rate information.

Name must be unique to the state (so it cannot be "OHIO STATE") Code must not have any spaces min 2 characters Description is free text rate is entered as a percentage effective date for example will be 09/01/13 if the tax takes effect on September 1st.

Once finished and saved we can go back to the OH Tax Tables tab [edit] and select the new tax rate from the drop down either replacing the OHIO STATE rate in the State row or adding it by drop down in the county or city.

Now that we have an updated rate we can to the tax table update screen Maintain>> Sales Tax>> ShipTO/TaxTable Update. Select update and you're done!