Difference between revisions of "General Ledger Setup Guide"

From Adjutant Wiki

(→GL Cash Flow Codes (GLCASHFLOW)) |

(→Item Transaction Categories (ITEMCAT)) |

||

| Line 138: | Line 138: | ||

===Item Transaction Categories (ITEMCAT)=== | ===Item Transaction Categories (ITEMCAT)=== | ||

| − | Item Transaction Categories are used together with Customer Transaction Categories to define which Revenue and Cost accounts are used for different transaction types. Item Categories are defined in the rule, and tied to individual item records in the Item Master Settings tab, or the Item Master OHF record. The Item Category in the OHF record overrides the entry in the Setting tab. | + | Item Transaction Categories are used together with Customer Transaction Categories to define which Revenue and Cost accounts are used for different transaction types. Item Categories are defined in the rule, and tied to individual item records in the Item Master Settings tab, or the Item Master OHF record. The Item Category in the OHF record overrides the entry in the Item Master Setting tab. |

| − | |||

| − | |||

| + | http://www.abiscorp.com/adjwiki/rule-itemcat.ashx | ||

===GL Segments (GLSEGMENTS)=== | ===GL Segments (GLSEGMENTS)=== | ||

Revision as of 11:32, 28 February 2018

Contents

- 1 Overview

- 2 Initial Setup

- 3 Review and Update Rule Maintenance Records

- 3.1 Auto Batch Options (AUTOBATCH)

- 3.2 Customer Transaction Categories (CUSTCAT)

- 3.3 Item Transaction Categories (ITEMCAT)

- 3.4 GL Segments (GLSEGMENTS)

- 3.5 GL Batch Types (GLBATCH)

- 3.6 Inventory vs. GL Dump Accounts (INVDUMP)

- 3.7 GL Accounts for Inventory (INVGLACCTS)

- 3.8 GL Cash Flow Codes (GLCASHFLOW)

- 3.9 GL Statement of Earnings Report (GLSTATEEARN)

Overview

This guide covers the setup of the General Ledger application areas. The setup of the General Ledger application should be coordinated with the initial CID setup. There are several overlapping screens and steps between CID Maintenance and General Ledger setup.

Refer to the System Manager Setup Guide for a complete list of the setup items to complete in CID Maintenance.

Initial Setup

Set the CID GL Mask

- If the GL Mask field in the CID Maintenance – Accounts tab is open for editing, set the GL Mask value to match the customer’s GL account structure, using X and - characters.

- Generally, the GL Mask in the ‘Accounts’ tab must be updated via SQL with the following query

- Update CID set GLMASK = 'X-XXXX-XX' where CID = 'AAAA' (Set the GL Mask to the desired format using X and – characters. Replace ‘AAAA’ with actual CID)

Import the GL Chart of Accounts

- The GL Chart of Accounts import template can be found in the \Data Files\Accounting folder of the Adjutant directory (if copied from MASTER), or a copy can be found in the Implementation Files folder on the FTP.

- Import the customer’s complete chart of accounts using the ‘Chart of Accounts Import’ screen.

- Verify that the imported GL Accounts exist and are correct in the ‘GL Accounts’ screen.

- Request the 'GL Chart of Accounts Report' and compare against the source data to verify that all records imported successfully.

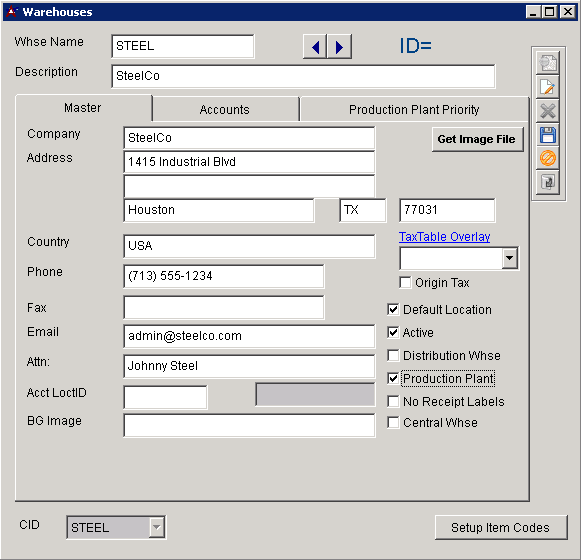

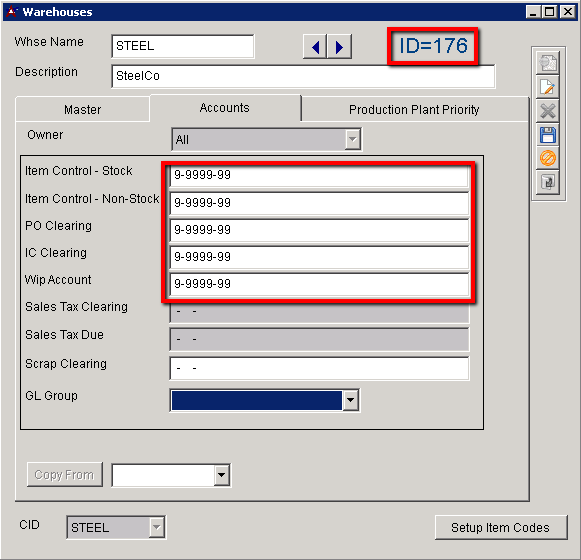

Set Up the Default Warehouse / Held For Records

This step may have been completed as part of the System Manager initial CID setup. If the Warehouse and Item Holder records have already been set up, review the GL accounts in the Warehouses - Accounts tab, and confirm that they are correct.

- The default Warehouse name should match the CID name. In most cases, the ‘Default Location’, ‘Active’, and ‘Production Plant’ checkboxes should be checked.

- The add process will create a new Organization with a ‘Warehouse Location’ attribute.

- You must complete the blank GL accounts in the ‘Account’ tab in order to save the record.

- Update the ‘Item Held For Codes’ (HOLDER) Rule Maintenance record with the new customer name and vendor number.

Complete the CID Maintenance - Accounting Backend Tab

This screen is used to integrate with third-party accounting and payroll systems, which is rare for new installations. Consult with development for the correct entries in this screen if you are setting up an interface.

- Otherwise, update the following fields as indicated:

- Name should be set to ‘None’

- Backend Type should be set to ‘Foxpro/None’

- Posting Window should be set to an appropriate date range for the current year (and beyond if desired)

- Note – these fields must be updated annually if they are set to a year at a time

- Default Costing Method should be set to the customer’s desired method (SI-AVG is generally best practice)

Complete the CID Maintenance - Fiscal Calendar Tab

This screen holds the valid fiscal periods and all associated dates for the accounting system.

- Edit the screen to set the ‘Current Year’ and ‘Current Period’ values. These set the default posting period in a variety of screens. They are updated when ‘Close GL Period/Year’ is processed.

- Fill out the Period Names/Start/End Dates for the current year based on the customer’s fiscal calendar. If the customer operates on a calendar year fiscal calendar, use the ‘Fill out DefCalYear’ button during an edit function to fill out the default start and end dates for the displayed year.

- Double-check the entry for February if you are adding a leap year

Complete the CID Maintenance – Accounts Tab

Complete the GL account entries in each field as per customer’s completed General Ledger Questionnaire.

Consult with customer on any blank account fields and confirm a valid account for each field. If a default account cannot be found, use a system suspense GL account and follow up in writing with the customer indicating which fields may cause issues down the road.

Clearing

- Work in Progress – WIP account for order/job cost, clears when invoiced, can be overridden by Warehouse entries, or Item-level entries

- Payroll – no longer used

- Equipment – Clearing account for equipment billing

- Inventory – Clearing account used in Inventory Adjustment transactions, can be overridden by Warehouse entries, or Item-level entries

- Purchase Orders – Clearing account between PO Receipt and AP Invoice entry, credited at PO Receipt and debited at AP Invoice entry, can be overridden by Warehouse entries, or Item-level entries

- Suspense – GL account used when the system can’t determine a valid GL account, forced balance

- Over/Under Billing – Clearing account for draw billing transactions in Project Control

- Retainage – Clearing account for retainage billing in Project Control

- Retained Earnings – Profit/Loss GL account used at EOY closing

- Exchange Gain/Loss -

- Sales Tax Clearing -

Accounts Payable

- Payables – Control account for accounts payable, can be overridden at the Sold From level

- Discount – Default account for calculated or approved AP Invoice discounts

- Adjustments – Default account for AP Invoice adjustments, can be overridden at Remit To level, or AP Invoice Approval level

- Checking – Default checking account for AP transactions

- Purchase Variance – Default balancing account between PO Receipt value and AP Invoice value

- PrePay Expense – Default account used when creating a PrePaid Check,

- Retainage AP – Used in AP Invoice transactions where retainage is calculated

Accounts Receivable

- Accounts Receivable – Default AR account, can be overridden by POS AR account, AR Account in SOTYPE2 rule, or at the Bill To level

- Sales Tax – Default sales tax liability account used at invoicing, can be overridden by STATES rule

- Cash Receipts – Default checking/cash account, also set in System Cash/Checking Accounts screen, can be overridden during Apply Cash Receipts

- Payment Discounts – Default account used for discounts applied against invoice, can be overridden at the Bill To level

- Payment Adjustments – Default account used for cash receipt adjustments, can be overridden during Apply Cash Receipts

- Retainage AR – Used in AR transactions where retainage is calculated

- POS AR – (optional) AR Account used for point-of-sale receipts

- Open Credit/AR – Default account used when creating an open credit in Apply Cash Receipts, can be overridden

Inventory

- Stock Inv – Default stock inventory control account, can be overridden at Warehouse, or item level

- Non-Stock Inv – Default non-stock inventory control account, can be overridden at Warehouse, or item level

- Return Loss – Inventory control account that is debited when stock items are returned, but not returned to stock

- Transfer Clearing – Clearing account for inventory transfers

- Modification Clearing – Clearing account for certain Modification Processor transactions

- Scrap Adjustment – Offset account for scrap adjustment transactions

Review and Update Rule Maintenance Records

Auto Batch Options (AUTOBATCH)

The AUTOBATCH controls the automatic nightly accounting batch generation, invoice processing, and posting options.

- The AUTOBATCH Setup Option must be enabled in order to automate batches.

- The Auto Batch process must be added to the Auto Process Schedule.

http://www.abiscorp.com/adjwiki/RULE-AUTOBATCH.ashx

Customer Transaction Categories (CUSTCAT)

Customer Transaction Categories are used together with Item Transaction Categories to define which Revenue and Cost accounts are used for different transaction types. Customer Categories can be tied to customer records in either the Sold To, Ship To, or the Bill To attribute screen. The CUSTCAT rule must be set up with at least a DEF code.

http://www.abiscorp.com/adjwiki/rule-custcat.ashx

Item Transaction Categories (ITEMCAT)

Item Transaction Categories are used together with Customer Transaction Categories to define which Revenue and Cost accounts are used for different transaction types. Item Categories are defined in the rule, and tied to individual item records in the Item Master Settings tab, or the Item Master OHF record. The Item Category in the OHF record overrides the entry in the Item Master Setting tab.

http://www.abiscorp.com/adjwiki/rule-itemcat.ashx

GL Segments (GLSEGMENTS)

GL Segments are used for Financial Report Writer customization and can also be used to filter GL Distribution reports. The GLSEGMENTS rule should be added with an entry that defines or categorizes each segment of the GL Mask. Typical segment examples are Account, Branch or Company, and Department.

There is a corresponding GL Segment Values screen that should be set up to allow further detail and customization for Financial Report Writer.

GL Batch Types (GLBATCH)

The GLBATCH rule from the MASTER CID setup should have every batch type needed for a new implementation. Verify that the rule contains the eight (8) entries needed. Consult the MASTER CID rule example if needed.

Inventory vs. GL Dump Accounts (INVDUMP)

This rule controls the valid GL accounts that are included in the automatic nightly inventory reconciliation report and the report options. AR, AP and INV accounts can be specified in the rule to generate sections for each account type. The rule must be set up with at least one GL account in order to generate the report.

GL Accounts for Inventory (INVGLACCTS)

This is a companion rule to the INVDUMP rule. Each account set up in the INVDUMP rule must also be added to this rule in order for everything to work.

GL Cash Flow Codes (GLCASHFLOW)

GL Cash Flow Codes are an optional setup to control the grouping and calculations on the GL Cash Flow Report. The Cash Flow Report was a custom report for a specific customer, but could be used for any customer interested in analyzing cash flow activities. Cash Flow Codes and options are set up in the rule and assigned to individual GL accounts in the GL Accounts screen.

GL Statement of Earnings Report (GLSTATEEARN)

The GLSTATEEARN rule is an optional setup item to control the grouping and custom calculations for the Statement of Earnings Report. The Statement of Earninsg Report was a custom report developed for a specific customer, but could be used for any customer.

==