Difference between revisions of "Import Asset"

From Adjutant Wiki

| Line 7: | Line 7: | ||

'''TAGID''' Asset Tag | '''TAGID''' Asset Tag | ||

| − | + | '''NAME''' Name of asset | |

| − | + | '''OWNER''' Organization that owns the asset | |

| − | + | '''DEPT''' Enter the department that controls/ owns the asset | |

| − | + | '''SERIAL''' Enter the serial number on each asset | |

| − | + | '''DESCRIP''' The description of the asset | |

| − | + | '''BasedOn''' When an asset is used in billing, fill out what item this asset is based on | |

| − | + | '''ENTRYDATE''' The Entry Date for the asset into the system | |

| − | + | '''SVRDATE''' Enter the in-service date for this asset | |

| − | + | '''LIFE''' Depreciation lifespan of the asset in years | |

| − | + | '''BUSUSE''' Percentage the asset is used for business purposes | |

| − | + | '''FEDLIFE''' Federal Depreciation: The estimated depreciable life of the asset, according to the convention selected | |

| − | + | '''FEDCOST''' Federal Depreciation: Asset Cost | |

| − | + | '''FEDSALVAGE''' Federal Depreciation: The salvage value of the asset | |

| − | + | '''FEDMETH''' Federal Depreciation: Method of depreciation; SL, DB200, DB150, SY | |

| − | + | '''FEDCONV''' Federal Depreciation: Half-Year, Quarter, Mid Month, or Full Month | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| + | '''STLIFE''' State Depreciation: The estimated depreciable life of the asset, according to the convention selected | ||

| + | '''STCOST''' State Depreciation: Asset Cost | ||

| + | '''STSALVAGE''' State Depreciation: The salvage value of the asset | ||

| + | '''STMETH''' State Depreciation: Half-Year, Quarter, Mid Month, or Full Month | ||

| + | '''STCONV''' State Depreciation: The estimated depreciable life of the asset, according to the convention selected | ||

| + | '''AMTLIFE''' Amount Depreciation: The estimated depreciable life of the asset, according to the convention selected | ||

| + | '''AMTCOST''' Amount Depreciation: Asset Cost | ||

| + | '''AMTSALVAGE''' Amount Depreciation: The salvage value of the asset | ||

| + | '''AMTMETH''' Amount Depreciation: Method of depreciation; SL, DB200, DB150, SY | ||

| + | '''AMTCONV''' Amount Depreciation: Half-Year, Quarter, Mid Month, or Full Month | ||

| + | |||

| + | '''BKLIFE''' Book Depreciation: The estimated depreciable life of the asset, according to the convention selected | ||

| + | '''BKCOST''' Book Depreciation: Asset Cost | ||

| + | '''BKSALVAGE''' Book Depreciation: The salvage value of the asset | ||

| + | '''BKMETH''' Book Depreciation: Method of depreciation; SL, DB200, DB150, SY | ||

| + | '''BKCONV''' Book Depreciation: Half-Year, Quarter, Mid Month, or Full Month | ||

| + | |||

| + | '''NOTE''' Additional Asset reference notes (not needed) | ||

| + | '''CURLOC''' Assets current location (not needed) | ||

| − | |||

[[Media:Asset_import.xlsx| Import Example]] | [[Media:Asset_import.xlsx| Import Example]] | ||

Revision as of 17:12, 10 January 2023

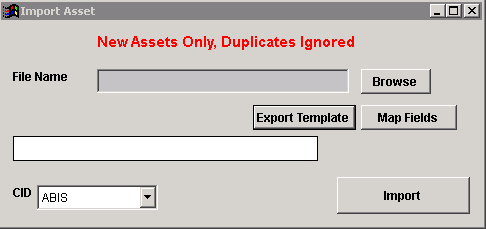

End user process to import an asset.

Filters

TAGID Asset Tag NAME Name of asset OWNER Organization that owns the asset DEPT Enter the department that controls/ owns the asset SERIAL Enter the serial number on each asset DESCRIP The description of the asset BasedOn When an asset is used in billing, fill out what item this asset is based on ENTRYDATE The Entry Date for the asset into the system SVRDATE Enter the in-service date for this asset LIFE Depreciation lifespan of the asset in years BUSUSE Percentage the asset is used for business purposes

FEDLIFE Federal Depreciation: The estimated depreciable life of the asset, according to the convention selected FEDCOST Federal Depreciation: Asset Cost FEDSALVAGE Federal Depreciation: The salvage value of the asset FEDMETH Federal Depreciation: Method of depreciation; SL, DB200, DB150, SY FEDCONV Federal Depreciation: Half-Year, Quarter, Mid Month, or Full Month

STLIFE State Depreciation: The estimated depreciable life of the asset, according to the convention selected STCOST State Depreciation: Asset Cost STSALVAGE State Depreciation: The salvage value of the asset STMETH State Depreciation: Half-Year, Quarter, Mid Month, or Full Month STCONV State Depreciation: The estimated depreciable life of the asset, according to the convention selected

AMTLIFE Amount Depreciation: The estimated depreciable life of the asset, according to the convention selected AMTCOST Amount Depreciation: Asset Cost AMTSALVAGE Amount Depreciation: The salvage value of the asset AMTMETH Amount Depreciation: Method of depreciation; SL, DB200, DB150, SY AMTCONV Amount Depreciation: Half-Year, Quarter, Mid Month, or Full Month

BKLIFE Book Depreciation: The estimated depreciable life of the asset, according to the convention selected BKCOST Book Depreciation: Asset Cost BKSALVAGE Book Depreciation: The salvage value of the asset BKMETH Book Depreciation: Method of depreciation; SL, DB200, DB150, SY BKCONV Book Depreciation: Half-Year, Quarter, Mid Month, or Full Month

NOTE Additional Asset reference notes (not needed) CURLOC Assets current location (not needed)

Additional Information

Please visit our wiki page here! discussing the basics of how the asset importer runs.