Difference between revisions of "Import Asset"

From Adjutant Wiki

| Line 5: | Line 5: | ||

===Filters=== | ===Filters=== | ||

| − | ''' | + | |

| + | '''TAGID''' Asset Tag | ||

| + | <br\>'''NAME''' Name of asset | ||

<br\>'''OWNER''' Organization that owns the asset | <br\>'''OWNER''' Organization that owns the asset | ||

| − | + | <br\>'''DEPT''' Enter the department that controls/ owns the asset | |

| − | |||

| − | |||

| − | <br\>'''DEPT''' | ||

| − | |||

| − | |||

<br\>'''SERIAL''' Enter the serial number on each asset | <br\>'''SERIAL''' Enter the serial number on each asset | ||

| − | |||

<br\>'''DESCRIP''' The description of the asset | <br\>'''DESCRIP''' The description of the asset | ||

| + | <br\>'''BasedOn''' When an asset is used in billing, fill out what item this asset is based on | ||

<br\>'''ENTRYDATE''' The Entry Date for the asset into the system | <br\>'''ENTRYDATE''' The Entry Date for the asset into the system | ||

| − | <br\>'''SVRDATE''' | + | <br\>'''SVRDATE''' Enter the in-service date for this asset |

| − | <br\>'''LIFE''' | + | <br\>'''LIFE''' Depreciation lifespan of the asset in years |

| − | <br\>''' | + | <br\>'''BUSUSE''' Percentage the asset is used for business purposes |

| − | <br\>''' | + | |

| − | <br\>''' | + | <br\>'''FEDLIFE''' Federal Depreciation: The estimated depreciable life of the asset, according to the convention selected |

| − | <br\>''' | + | <br\>'''FEDCOST''' Federal Depreciation: Asset Cost |

| − | <br\>''' | + | <br\>'''FEDSALVAGE''' Federal Depreciation: The salvage value of the asset |

| − | <br\>''' | + | <br\>'''FEDMETH''' Federal Depreciation: Method of depreciation; SL, DB200, DB150, SY |

| − | <br\> | + | <br\>'''FEDCONV''' Federal Depreciation: Half-Year, Quarter, Mid Month, or Full Month |

| − | <br\>''' | + | <br\> |

| − | <br\>''' | + | <br\>'''STLIFE''' State Depreciation: The estimated depreciable life of the asset, according to the convention selected |

| − | <br\>''' | + | <br\>'''STCOST''' State Depreciation: Asset Cost |

| − | <br\>''' | + | <br\>'''STSALVAGE''' State Depreciation: The salvage value of the asset |

| − | <br\>''' | + | <br\>'''STMETH''' State Depreciation: Half-Year, Quarter, Mid Month, or Full Month |

| − | <br\> | + | <br\>'''STCONV''' State Depreciation: The estimated depreciable life of the asset, according to the convention selected |

| − | <br\>''' | + | <br\> |

| − | <br\>''' | + | <br\>'''AMTLIFE''' Amount Depreciation: The estimated depreciable life of the asset, according to the convention selected |

| − | <br\>''' | + | <br\>'''AMTCOST''' Amount Depreciation: Asset Cost |

| − | <br\>''' | + | <br\>'''AMTSALVAGE''' Amount Depreciation: The salvage value of the asset |

| − | <br\>''' | + | <br\>'''AMTMETH''' Amount Depreciation: Method of depreciation; SL, DB200, DB150, SY |

| − | <br\> | + | <br\>'''AMTCONV''' Amount Depreciation: Half-Year, Quarter, Mid Month, or Full Month |

| − | <br\>''' | + | <br\> |

| − | <br\>''' | + | <br\>'''BKLIFE''' Book Depreciation: The estimated depreciable life of the asset, according to the convention selected |

| − | <br\>''' | + | <br\>'''BKCOST''' Book Depreciation: Asset Cost |

| − | <br\>''' | + | <br\>'''BKSALVAGE''' Book Depreciation: The salvage value of the asset |

| − | <br\>''' | + | <br\>'''BKMETH''' Book Depreciation: Method of depreciation; SL, DB200, DB150, SY |

| − | <br\> | + | <br\>'''BKCONV''' Book Depreciation: Half-Year, Quarter, Mid Month, or Full Month |

| − | <br\>''' | + | <br\> |

| − | <br\>''' | + | <br\>'''NOTE''' Additional Asset reference notes (not needed) |

| + | <br\>'''CURLOC''' Assets current location (not needed) | ||

| + | |||

Revision as of 14:47, 6 August 2013

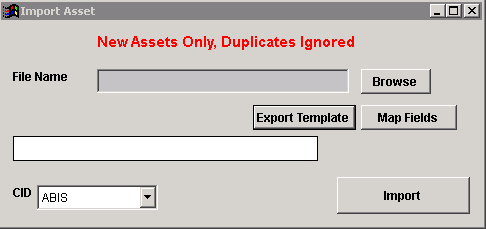

End user process to import an asset.

Filters

TAGID Asset Tag <br\>NAME Name of asset <br\>OWNER Organization that owns the asset <br\>DEPT Enter the department that controls/ owns the asset <br\>SERIAL Enter the serial number on each asset <br\>DESCRIP The description of the asset <br\>BasedOn When an asset is used in billing, fill out what item this asset is based on <br\>ENTRYDATE The Entry Date for the asset into the system <br\>SVRDATE Enter the in-service date for this asset <br\>LIFE Depreciation lifespan of the asset in years <br\>BUSUSE Percentage the asset is used for business purposes

<br\>FEDLIFE Federal Depreciation: The estimated depreciable life of the asset, according to the convention selected <br\>FEDCOST Federal Depreciation: Asset Cost <br\>FEDSALVAGE Federal Depreciation: The salvage value of the asset <br\>FEDMETH Federal Depreciation: Method of depreciation; SL, DB200, DB150, SY <br\>FEDCONV Federal Depreciation: Half-Year, Quarter, Mid Month, or Full Month <br\> <br\>STLIFE State Depreciation: The estimated depreciable life of the asset, according to the convention selected <br\>STCOST State Depreciation: Asset Cost <br\>STSALVAGE State Depreciation: The salvage value of the asset <br\>STMETH State Depreciation: Half-Year, Quarter, Mid Month, or Full Month <br\>STCONV State Depreciation: The estimated depreciable life of the asset, according to the convention selected <br\> <br\>AMTLIFE Amount Depreciation: The estimated depreciable life of the asset, according to the convention selected <br\>AMTCOST Amount Depreciation: Asset Cost <br\>AMTSALVAGE Amount Depreciation: The salvage value of the asset <br\>AMTMETH Amount Depreciation: Method of depreciation; SL, DB200, DB150, SY <br\>AMTCONV Amount Depreciation: Half-Year, Quarter, Mid Month, or Full Month <br\> <br\>BKLIFE Book Depreciation: The estimated depreciable life of the asset, according to the convention selected <br\>BKCOST Book Depreciation: Asset Cost <br\>BKSALVAGE Book Depreciation: The salvage value of the asset <br\>BKMETH Book Depreciation: Method of depreciation; SL, DB200, DB150, SY <br\>BKCONV Book Depreciation: Half-Year, Quarter, Mid Month, or Full Month <br\> <br\>NOTE Additional Asset reference notes (not needed) <br\>CURLOC Assets current location (not needed)

<br\> Import Example

Additional Information

Please visit our wiki page here! discussing the basics of how the asset importer runs.