Difference between revisions of "Bank Reconciliation Go-Live Guide"

From Adjutant Wiki

| Line 37: | Line 37: | ||

**You should be able to reconcile the bank GL account ending balance to the bank statement balance plus the uncleared legacy transactions | **You should be able to reconcile the bank GL account ending balance to the bank statement balance plus the uncleared legacy transactions | ||

| − | + | [[File:BANKREC_1.png]] | |

*Verify that the Bank Rec screen is clear of all test data and pre go-live activity for all bank accounts. | *Verify that the Bank Rec screen is clear of all test data and pre go-live activity for all bank accounts. | ||

| Line 49: | Line 49: | ||

**Post to GL and Cash Transfer should be left blank, since the imported GL balance already includes this amount. | **Post to GL and Cash Transfer should be left blank, since the imported GL balance already includes this amount. | ||

| − | + | [[File:BANKREC_2.png]] | |

*Clear the opening balance adjustment in the Checks/Deposits/Adjustments tab. | *Clear the opening balance adjustment in the Checks/Deposits/Adjustments tab. | ||

Revision as of 15:50, 18 December 2018

Contents

Overview

This guide covers the procedures for properly setting the Bank Reconciliation (Bank Rec) initial Bank and Book balances so that it can be properly reconciled after go-live.

Preparation

Work with the customer during the implementation to understand their bank reconciliation procedures for all bank accounts that they intend to use with Bank Rec. For each bank account, you will need to discuss the following items with the customer and make sure they understand how to provide these details.

Bank Statement Cutoff Date: The bank statement cutoff date, or statement ending date, will determine the timing for entering the Bank rec starting adjustment. It will also determine which outstanding (uncleared) details need to be tracked and adjusted into Bank Rec.

Go-Live Date: All bank account transactions (checks and deposits) from the legacy system that are uncleared as of the customer's most current bank statement dated prior to the go-live date will need to be individually adjusted, or imported into Bank Rec. Additionally, all bank account transactions that occur in the legacy system after the bank statement cutoff date and before the go-live date will also need to be added to Bank Rec. Get a clear understanding of the timing between the bank statement cutoff data and the go-live date to set the customer expectation for the data that will need to be tracked in the month prior to go-live. If this expectation is not set up front, it can be difficult for some customers to recreate the details needed to properly set up Bank Rec. If the customer is properly tracking all uncleared transactions with the right expectations, the reconciliation should go smoother.

Bank Statement Ending Balance: The reconciled bank account ending balance as of the most current statement date will be used to set the beginning Book Balance for Bank Rec. The customer should reconcile their current statement on teh legacy system and confirm the bank statement ending balance number. This will establish a firmly reconciled value to begin Bank Rec. For example, if the Adjutant go-live occurs in October, customers should use their September closing bank statement value to enter as the opening manual adjustment value for Bank Rec. If the statement cutoff date is September 20, all current uncleared transactions prior to 9/20, and all transactions that occur in the legacy system on or after 9/20 will have to be tracked and adjusted into Bank Rec for reconciliation.

Uncleared Legacy Check Transactions: All check transactions that remain uncleared on the customer's most current bank statement, as well as all check transactions that are created on the legacy system after the most current statement will need to be adjusted into Bank Rec. Uncleared check transactions can include checks that are weeks or months old. If the customer is actively reconciling their bank statement, they should be aware of all uncleared checks that have not shown up on their bank statements.

Uncleared Legacy Deposit Transactions: All deposit transactions that remain uncleared on the customer's most current bank statement, as well as all deposit transactions that are created after the most current statement will need to be adjusted into Bank Rec. Deposit transactions generally clear immediately, or within a business day. This data should generally include deposits that happen around the bank statement cutoff date, and all deposits that happen between the statement cutoff date and the go-live date.

Uncleared Legacy Other Transactions: Any other bank transactions that don't fall into either check or deposit categories should follow the same rules. All uncleared other transactions as of the most current bank statement, as well as all other transactions that happen between the cutoff date and the go-live date will need to be adjusted into Bank Rec.

Procedures

Develop a plan with the customer to gather and adjust all uncleared bank transactions from the legacy system into Bank Rec that makes sense for the overall go-live plan. If the Bank Rec initial reconciliation will not be possible prior to live transactions in Adjutant, you will need to use the As-Of Date mode in Bank Rec to keep the live transactions separate from the reconciliation entries.

The example procedures below will assume the following details:

- Go-Live Date of October 1

- Bank Statement cutoff date of September 20

- Bank Statement ending balance of $8,097,574.88

- Uncleared checks totaling $142,000.00

- Uncleared deposits totaling $342,000.00

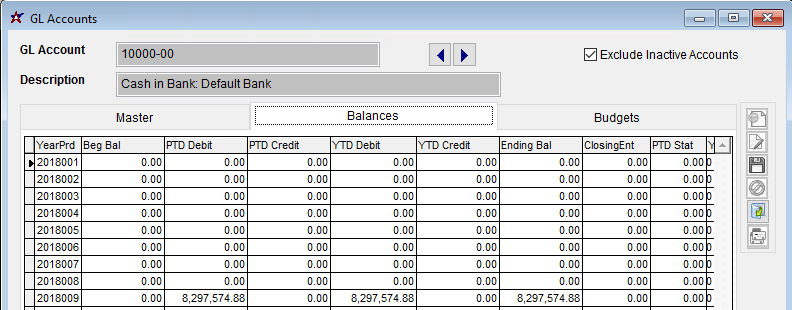

- Imported bank GL ending balance for September of $8,297,574.88

- The ending balances for the month prior to go-live should be imported and reconciled. Note the ending balance for each bank account, for the month prior to go-live.

- You should be able to reconcile the bank GL account ending balance to the bank statement balance plus the uncleared legacy transactions

- Verify that the Bank Rec screen is clear of all test data and pre go-live activity for all bank accounts.

- For all bank accounts, select the 'All' Status filter and verify that the Bank and Book Balance are zero, with no transactions listed. If this is happening after live transactions have been added in the go-live month, be sure to set the as-of date accordingly to exclude the live transactions.

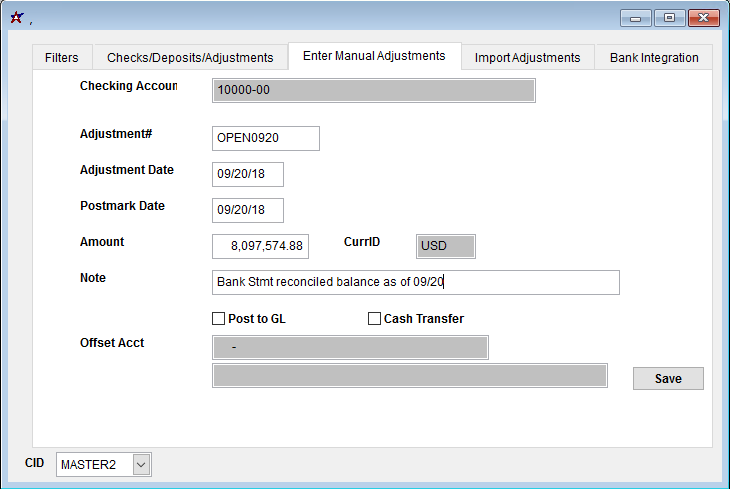

- Enter the most current, reconciled bank statement ending balance as a manual adjustment in the Bank Rec screen.

- The Adjustment # should be an obvious reference to the opening balance

- The Adjustment Date and Postmark Date should be entered as the statement cutoff date

- The Amount should be the bank statement ending balance value

- The Note entry will display in the Company column of Bank Rec. Enter something useful.

- Post to GL and Cash Transfer should be left blank, since the imported GL balance already includes this amount.

- Clear the opening balance adjustment in the Checks/Deposits/Adjustments tab.

- Set the clear date field at the top of the screen to either the end of month date for the month prior to go-live, or to the bank statement cutoff date. It will default to the current date, which is not desired.

- At this point, the Bank Balance and the Book Balance should be equal.

- Click Update to save the cleared adjustment.

balance clearring pic

- Enter any/all uncleared deposit transactions from the legacy system. These can be imported as Bank Rec adjustment records using the Import Adjustments tab. Or, they can be manually entered as adjustments similar to the process used to enter the bank statement balance amount. Deposit entries should be entered individually, rather than being lumped into a single adjustment. If there are any discrepancies in reconciling, a lump sum entry will not help.

- When either building the adjustment import file, or entering the adjustments manually, follow the guidelines below.

- The Adjustment # should be an obvious reference to deposit reference number

- The Adjustment Date and Postmark Date should be entered as the original deposit date

- The Amount should be the amount of the deposit. A debit sign is assumed.

- The Note entry will display in the Company column of Bank Rec. Enter something useful.

- Post to GL and Cash Transfer should be left blank, since the imported GL balance already includes this amount.

import & manual entry pic

- After importing or entering all deposit adjustments, review the entries in the Checks/Deposits/Adjustments tab. Remember to use the As-Of Date in the Filters tab if live transactions have already been created.

- At this point, the Bank Balance should reflect the original statement ending balance adjustment, and the Book Balance should equal the balance adjustment plus all of the deposit transactions.

- The Variance should equal the sum of all entered deposit transactions.

- These do not need to be cleared at this step. The customer can clear them just as they would clear live transactions when they receive their next statement.

- If the customer wishes to clear them now, remember to update the clear date to the month prior to the go-live date to avoid confusion.

deposit entries pic

- Use the AP Check Import screen to import all uncleared check transactions from the legacy system.

- Follow the AP Check Import Guide for details on the format and procedures for import AP check records that will populate the Bank Rec screen.

import screen pic

- AP Checks can also be entered as adjustments, but there are few items to note:

- They will not show up as checks

- They will not be tied to a company record, but you can enter the company name in the Note field for display

- Check adjustment amounts must be entered as credit amounts. If using the import, you do not need to enter them as credits because the import assumes it.

- The Adjustment # should be entered as the check #.

- Check adjustment records should not be posted to the GL

- After importing, or adjusting in, all uncleared check details from the legacy system, review the entries in the Checks/Deposits/Adjustments tab. Remember to use the As-Of Date in the Filters tab if live transactions have already been created.

- At this point, the Bank Balance should reflect the original statement ending balance adjustment, and the Book Balance should equal the balance adjustment plus all of the deposit transactions and minus the check transactions.

- The Variance should equal the net balance of all entered deposit and check transactions.

- These do not need to be cleared at this step. The customer can clear them just as they would clear live transactions when they receive their next statement.

- If the customer wishes to clear them now, remember to update the clear date to the month prior to the go-live date to avoid confusion.

post check import pic

- If there are any uncleared transactions that do not fall under the deposit or check category, but need to be adjusted in so that the bank GL account balance reconciles, enter them as adjustments. Follow the same guidelines as the deposit adjustment procedure, but be sure to manually set the correct amount sign for credits, if applicable.

- After all prior month transactions have been entered, you should be able to reconcile the Book Balance to the bank GL account balance (remember to set the As-Of Date if needed).

- With all adjusted and imported details loaded, if you clear all transactions, the Bank Balance and the Book Balance should equal.

- The Book Balance should equal the bank GL balance for the prior month ending balance.

Wrap-up

Document the reconciled Bank Rec screen by capturing a screen image of the reconciled values AND use the print button to save a copy of all imported transactions as of the reconciliation point. Save all reconciliation materials to share with the customer.

With a properly reconciled Bank Rec system at go-live, it is much easier to troubleshoot and remedy any reconciliation issues going forward.