Implementing the New 1099-NEC Changes for Tax Year 2020Overview

This guide will cover the actions required in Adjutant to update the 1099 Reporting software to accurately report nonemployee compensation amounts on the new 1099-NEC form required by the IRS for tax year 2020.

The steps included in this guide are intended for a Systems Administrator level user or a user that has experience updating Rule Maintenance records. The Rule Maintenance screen is a powerful, system-level control screen with the potential to cause major issues if changes are not handled properly. If you have any concerns about following the steps in this guide, or have any questions along the way, contact your Strategist (aka Consultant) for assistance.

Step 1 - January 2021 Desktop Release

The January 2021 Desktop Software Release, available on Monday, January 18, contains the updated forms and the development needed to support the changes and produce the 1099-NEC form for tax year 2020.

All customers who need to produce 1099-NEC forms from Adjutant should update their Desktop platform to the January 2021 release.

Follow the procedures outlined in the

End User Update Tool wiki page for detailed instructions on updating the Desktop platform to the latest available release version.

If you are unable to update your system to the January 2021 release for any reason, a custom solution will have to be developed for your system to accommodate the new 1099-NEC form and changes to the 1096 Form. Contact your Strategist for assistance on implementing the new forms.

Step 2 - Rule Maintenance Changes Needed¶

The

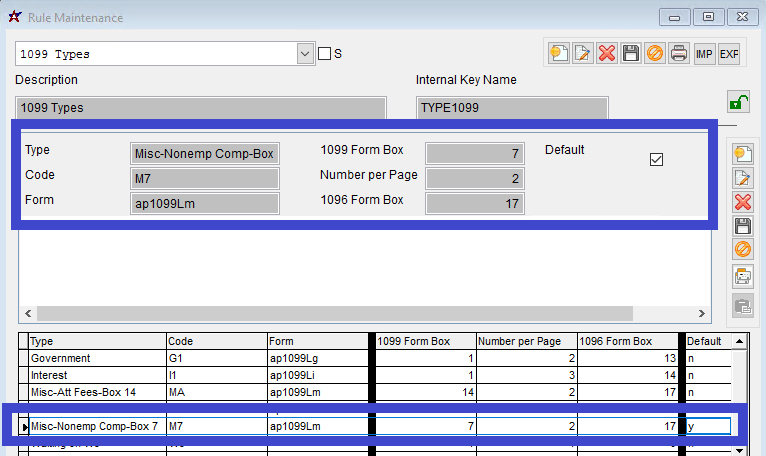

1099 Types (TYPE1099) Rule Maintenance record holds the valid 1099 types and forms settings in use for your organization. Keep in mind that the rule description name (1099 Types) may be different in your environment, but the Internal Key Name (TYPE1099) will be the same for all systems.

- Locate the 1099 Types rule in the Rule Maintenance screen. Below is an example of the rule:

TYPE1099 Rule Example |

- NOTE - If the 1099 Types rule does not include the 1096 Forms Box field, it will need to be added to the rule control (header) record. If you are unfamiliar with making changes to the rule control records, contact your Strategist for assistance with this step.

- The Type descriptive names (first column in the lower grid) will be unique for every organization and may not match the example images. In this example, the ‘Misc-NonempComp-Box 7’ type is highlighted, but your type descriptions will likely be different.

!WARNING! – Do not change the Type description for any of the rule detail entries! The entry in the Type field is used in the database and any changes to these values will result in a data loss for the associated vendors’ 1099 settings. Your Strategist can assist you with updating these type descriptions, but it requires a database-level change to ensure that all associated records are accurately updated.

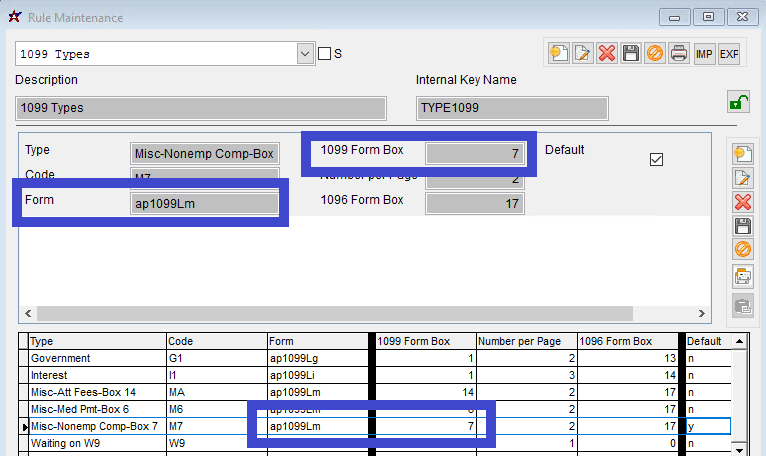

- Locate any rule detail record that has the combination of Form ‘ap1099Lm’ and 1099 Form Box ‘7’ (image below). These are the 1099 Types that were previously printed in box 7 on the 1099-MISC form and will now be printed in box 1 of the 1099-NEC form. These rule detail records will need to be changed.

1099 Misc Box 7 Example |

- For each rule detail pointed to Form ‘ap1099Lm’ and 1099 Box ‘7’, make the following changes:

- Change the Form to ‘ap1099Lnec’

- Change the 1099 Form Box to ‘1’

- Change the 1096 Form Box to ‘20’

- Below is an example of an updated rule detail record that has been set to use the new 1099-NEC form correctly. As a reminder, the description in the Type field will likely be different in your system.

1099 NEC Settings |

- Once the Rule Maintenance changes from Step 3 have been made to ALL 1099 Types that were previously reported in 1099-MISC box 7, AND the January 2021 Software Release has been updated, you are ready to produce the new 1099-NEC form and the updated 1096 Form.

Step 3 – Produce 1099 and 1096 Forms¶

Adjutant’s Print 1099s process create the 1099 and 1096 forms based on the settings in the 1099 Types Rule Maintenance record. Once all the above actions have been completed, produce your tax year 2020 forms following your normal procedures.

A general guide for creating 1099 forms from the Print 1099 screen can be found on the wiki

here.

1099-NEC FormAny 1099 Type selected from the drop-down that has had the changes made in Rule Maintenance to produce the new ‘ap1099Lnec’ form will create the new Standard 1099-NEC form in Message Control.

- Because this is an entirely new form, we recommend that you limit the first print request to a single page or just a few pages to verify the alignment. The Standard form was created using official IRS laser printer forms, but differences in printers and printer environments can cause unique results.

- A custom form can be created from the Standard and the custom version can be adjusted as needed if there are any alignment changes needed. Consult your Strategist if you need any help with form customization.

1096 FormSelecting the ‘1096 Report’ field generates the 1096 Form for the selected 1099 Type. The Standard 1096 Form has been updated at the system level to meet the 2020 tax year standards.

Note about Custom 1096 FormsIf you have ever created a custom version of the 1096 form that is defaulted for your CID environment, Message Control will default to your custom form AND WILL NOT use the updated standard form for 2020.

- In order to use the updated Standard 1096 Form designed to work with the changes made for the new 1099-NEC Form, you must switch the form selector in Message Control to use the Standard form.

- Because this is an entirely new form and you usually only get a couple of 1096 forms per package, we recommend that your first print attempt is on blank paper to check the alignment. The Standard form was created using official IRS laser printer forms, but differences in printers and printer environments can cause unique results.

- A custom form can be created from the new Standard and the custom version can be adjusted as needed if there are any alignment changes needed. Consult your Strategist if you need any help with form customization.

Conclusion

If you have any questions, do not hesitate to contact your Strategist for assistance.

If you would like to discuss updating the descriptive name(s) for your nonemployee compensation 1099 Types, contact your Strategist to specify the changes you need. The changes are not time-consuming, but they are highly sensitive and require database-level access that only Strategists have.