General Information

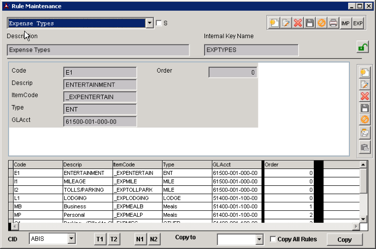

Default Menu Location: Maintain >> System >> Rule Maintenance >> Expense Types

Screen Name: RULEM

Applies To:

Expense Reports

Function: The Expense Types rule controls the following:

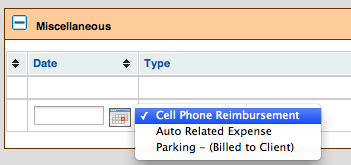

- Drop-down options presented to the user in each applicable section of the Expense Report.

Example of Expense Type option |

- The Item Code to use when billing a client for the expense.

- The GL Account to use when the expense is reimbursable.

You can download a good starting point for this rule

from here. You will need to modify the GL accounts and set up the Items.

Expense Types |

Fields

Text1: Two character unique code for the Expense Type.

Text2: The Description of the Expense Type.

Text3: The Item Code that will be used if the expense is billable.

Text4: The Expense Type/Section. Every expense type must fit into one of six categories:

- Mileage/Tolls (MILE)

- Travel (TRAVEL)

- Lodging (LODGE)

- Meals (MEALS)

- Entertainment (ENT)

- Miscellaneous (OTHER)

Text5: GL Account to be debited if the expense is reimbursable.

Number1: The order each type will appear in the corresponding drop-down list.

Related Videos

Create New Expense Types