Page History: Journal Entry Architecture - Invoicing

Compare Page Revisions

Page Revision: Tue, 16 Sep 2008 12:27

General Info

The Batch Generator can make several batch journal entries. One of the options is the batch for Invoicing (Sales Order shipment or Time Entry billing).

Many things affect which GL accounts will be debited or credited when creating an invoice. There are typically 5 accounts affected during invoicing:

1. Accounts Receivable

- AR is debited in the amount of the invoice.

2. Revenue

- Revenue is credited in the amount of the invoice less sales tax.

3. Sales Tax

- Sales Tax is credited in the amount of the tax on the invoice.

4. Cost of Good Sold

- COGS is debited based upon the cost of the items on the Sales Order.

5. Work in Process

- WIP is credited based upon the cost of the items on the Sales Order. WIP has already been debited when the SO was shipped, so this account is always a wash (not affected).

Journal Entry Architecture

This section will describe how each account is figured.

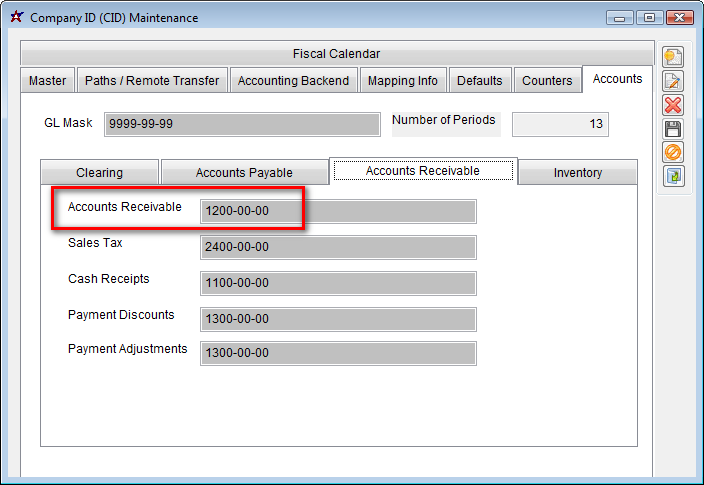

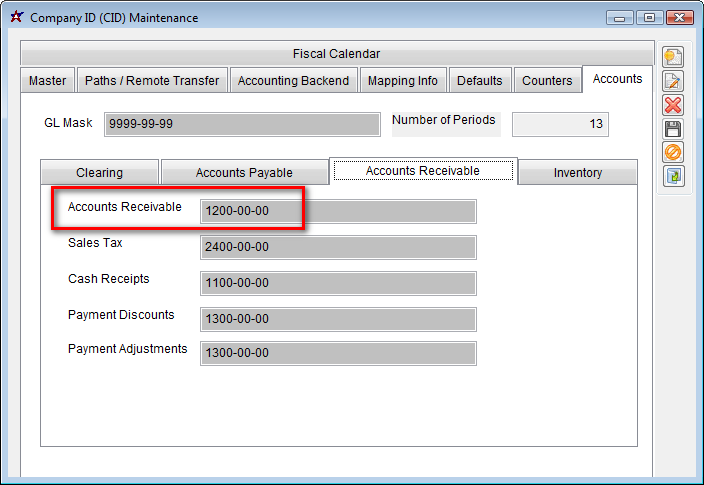

Accounts Receivable

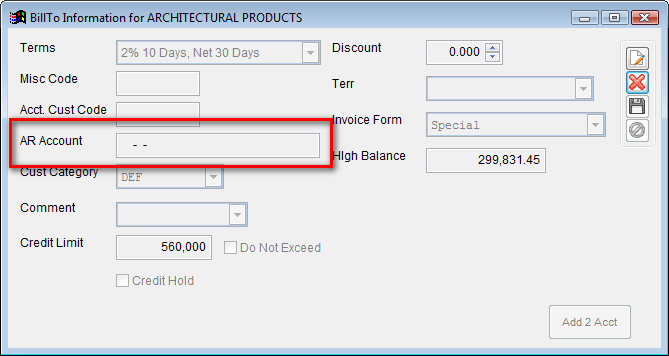

The AR account can be one of two accounts: The AR account on the CID Maintenance Screen or the AR account listed on the Bill To screen of the customer being invoiced.

CID Maintenance AR Account

CID Maintenance AR Account

Bill-To AR Account