Page History: Print 1099s

Compare Page Revisions

Page Revision: Tue, 29 Jan 2019 10:55

General Information

Default Menu Location: Transaction >> Accounts Payable >> Print 1099s

Screen Name: PRINTAP1099

Function: Recalculates prior & current year 1099 amounts according to Accounts Payable data and prints 1099 data onto approved IRS 1099 forms.

General Procedures

- First, use the Close/Recalc tab to select the desired reporting year, and use the Recalc Amounts button to rebuild the final 1099 amounts.

- The Recalc Amounts button rebuilds the 1099 totals for the selected reporting year based on AP Check transactions.

- Then, use the Print tab filters and settings to generate a List Report for review for each 1099 Type.

- After reviewing the list report, leave all three output checkboxes unchecked and click Output to produce the 1099 forms for the indicated 1099 Type.

- You can perform an Alignment Test before this step to confirm the form layout.

- To produce the 1096 Summary form for the indicated 1099 Type, check the 1096 Report box and click Output.

- If you need to also check box 7 of the 1096 form to indicate that the 1096 form includes 1099-MISC forms with non employee compensation, check both the 1096 Report and the Final 1096 boxes.

- Once all 1099 Type forms have been completed and submitted, you can use the Close 1099 Year button in the Close/Recalc tab to close out the selected reporting year.

Print Tab

Start/End Vendno - Use these filters to print a 1099 for one vendor or for a range of vendors.

Minimum Amount - Enter the current federal minimum amount to only report/print for vendors with a year-to-date 1099 amount greater than or equal to the amount entered. Leaving the filter blank allows you to generate a preliminary list of all 1099 vendors, regardless of the federal minimum.

The federal minimum amount has been $600 for several years, but is subject to change. Review federal guidelines for the 1099 year and enter the current amount.

1099 Type - Select the Type of 1099/1096 form you wish to produce. The 1099 Types are define in the 1099 Types Rule Maintenance record.

Please note that the forms for each 1099 type can be different, depending on the settings in the Rule Maintenance record.

Last Year/This Year - Select the desired 1099 reporting year. Last Year is generally appropriate when creating 1099s in January.

List Report - Check this box to view a report of 1099 Vendors that meet the minimum 1099 amount for the selected year.

1096 Report - Check this box to generate the 1096 Summary form for the selected 1099 Type and year.

Final 1096 - When this box is checked by itself, the 1099 forms for the selected 1099 Type and year will be produced. When this box is checked along with the 1096 Report box, a 1096 Summary form will be produced with the 1096 Box 7 field checked to indicate that the 1096 includes 1099-MISC forms with non employee compensation.

- Leave all three checkboxes unselected - List Report, 1096 Report, and Final 1096 - to output the results on 1099 forms.

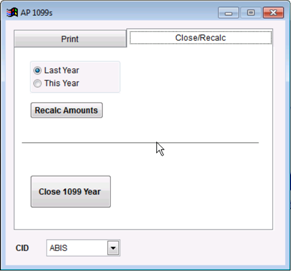

Close/Recalculate Tab

You should recalculate 1099 amounts from this tab before producing final 1099 forms for government reporting. This function recalculates the final 1099 amounts based on AP Check transactions from the selected year.

Choose the corresponding year (according to a calendar year) and click the

Recalc Amounts button to recalculate all 1099 amounts according to the

data entered in Accounts Payable.

The

Close 1099 Year button moves the current year's amounts into the prior year and resets the current year.

Print 1099 - Close/Recalc |